For the 24 hours to 23:00 GMT, the EUR rose 0.22% against the USD and closed at 1.1152.

On the data front, Euro-zone’s seasonally adjusted trade surplus narrowed to €19.2 billion in November, more than market expectations for a surplus of €21.2 billion. In the prior month, the nation has posted a revised surplus of €24.0 billion. Additionally, the region’s seasonally adjusted industrial production rose 0.2% on a monthly basis in November, less than market consensus for an increase of 0.3%. In the previous month, industrial production had recorded a revised fall of 0.9%.

In the US, data showed that the NY Empire State manufacturing index advanced to a level of 4.8 in January. In the preceding month, the index had recorded a revised level of 3.3. Moreover, the nation’s producer price index climbed 1.3% on an annual basis in December, rising at its weakest pace since August 2016 and signalling inflation pressures. In the previous month, the index had registered a rise of 1.1%. Furthermore, the MBA mortgage applications jumped 30.2% on a weekly basis in the week ended 10 January 2020. In the previous week, mortgage applications had recorded a rise of 13.5%.

The Federal Reserve’s (Fed) latest Beige Book revealed that the US economic activity expanded modestly in the last six months of 2019. The two districts, Richmond and Dallas exhibited above average growth, while Philadelphia, St. Louis, and Kansas City recorded sub-par growth. On the inflation front, the report indicated that the prices continued to advance at a modest pace. However, trade uncertainty and tariffs remained a concern for some businesses.

In the Asian session, at GMT0400, the pair is trading at 1.1153, with the EUR trading a tad higher against the USD from yesterday’s close.

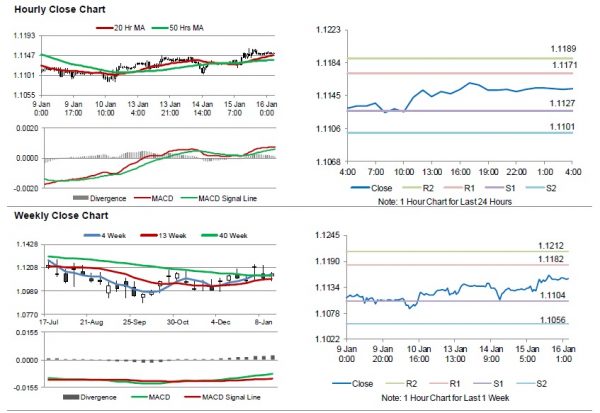

The pair is expected to find support at 1.1127, and a fall through could take it to the next support level of 1.1101. The pair is expected to find its first resistance at 1.1171, and a rise through could take it to the next resistance level of 1.1189.

Looking forward, investors would keep an eye on Germany’s consumer price index for December, slated to release in a while. Later in the day, the US retail sales for December, business inventories for November, the Philadelphia Fed Manufacturing Survey and the NAHB housing market index, both for January, along with initial jobless claims, would keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.