Key Highlights

- USD/CHF followed a bearish path and settled below the 0.9750 support.

- A crucial bearish trend line is forming with resistance at 0.9740 on the 4-hours chart.

- The US CPI is up 0.2% in Dec 2019 (MoM), whereas the forecast was 0.3%.

- The US PPI could increase 0.2% in Dec 2019 (MoM), up from the last 0%.

USD/CHF Technical Analysis

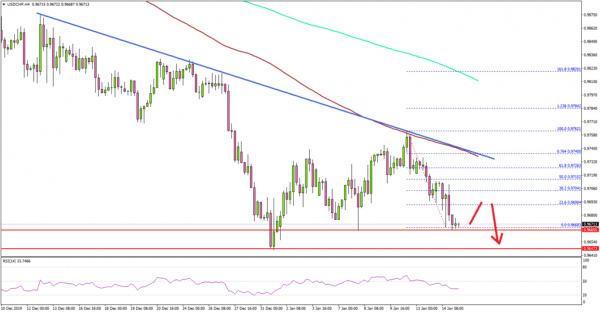

This past week, USD/CHF made an attempt to gain strength above 0.9750 and 0.9760. However, the US Dollar failed to surpass 0.9760 and started a fresh decline against the Swiss Franc.

Looking at the 4-hours chart, the pair topped near the 0.9762 level and recently declined below the 0.9740 and 0.9720 support levels.

Besides, the pair settled below 0.9720 and the 100 simple moving average (red, 4-hours). The recent low was near 0.9668 and the pair is currently consolidating losses.

An initial resistance is near the 0.9720 level, and the 50% Fib retracement level of the recent decline from the 0.9762 high to 0.9668 low. The main resistance on the upside is still near the 0.9750 level.

Moreover, there is a crucial bearish trend line forming with resistance at 0.9740 on the same chart. A clear close above 0.9750 is needed for a fresh increase towards 0.9800 and 0.9840.

Conversely, the pair is likely to continue lower below the 0.9660 and 0.9650 support levels. The next major support is near the 0.9620 level, below which USD/CHF could revisit 0.9600.

Fundamentally, the US Consumer Price Index for Dec 2019 was released by the US Bureau of Labor Statistics. The market was looking for the CPI to increase 0.3% in Dec 2019 compared with the previous month.

The actual result was lower than the forecast, as the US CPI increased 0.2%. Looking at the yearly change, there was a 2.3% rise, up from the last 2.1%.

The report added:

The indexes for gasoline, shelter, and medical care all rose in December, accounting for most of the increase in the seasonally adjusted all items index. The gasoline index increased 2.8 percent in December.

Overall, USD/CHF remains in a downtrend as long as it is below 0.9750. Besides, both EUR/USD and GBP/USD are facing an increase in selling pressure.

Upcoming Economic Releases

- UK Consumer Price Index Dec 2019 (YoY) – Forecast +1.5%, versus +1.5% previous.

- UK Core Consumer Price Index Dec 2019 (YoY) – Forecast +1.7%, versus +1.7% previous.

- US Producer Price Index Dec 2019 (MoM) – Forecast +0.2%, versus 0% previous.