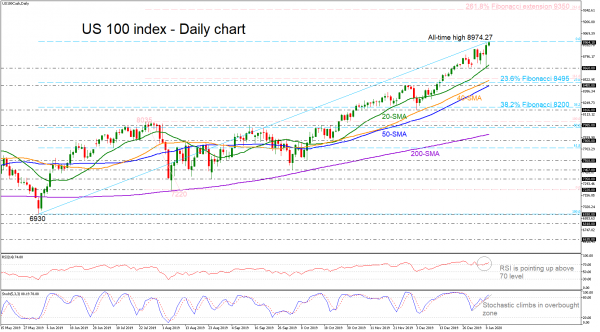

The US 100 index has been in a flying mode since yesterday, recording again a fresh all-time high around 8974.27 after it hit the 8660 support, which overlaps with the short-term 20-day simple moving average (SMA).

According to the RSI, the market could maintain positive momentum in the short-term as the indicator is positively sloped above its 70 level, though the fast Stochastics suggest that the market is located in overbought territory and therefore some weakness is possible; the blue %K line is fluctuating around the red %D line in overbought zone above 80.

In the positive scenario, where the price continues to expand above today’s high, a new top could probably be formed around the 261.8% Fibonacci extension level of the downward wave from 8035 to 7220 around 9350.

A reversal to the downside could stall at the 8660 support before challenging the crucial area within the 40- and 50-SMAs of 8515 – 8455, which encapsulates the 23.6% Fibonacci retracement level of the upleg from 6930 to 8974.27. Even lower, the 38.2% Fibo of 8200 could come into play.

The outlook continues to look predominantly bullish, with trading activity taking place near record highs.