Market movers today

It is a quiet day on the economic data front ahead of the US non-farm report tomorrow, which leaves the geopolitical crisis between Iran and the US in the spotlight. Given yesterday’s communication from both sides investors are likely to extend bets that the conflict can be contained with limited risk of further escalation short term.

German November industrial production will grab attention and will give us more clues to how the manufacturing sector has performed in Q4. Despite signs a trough is forming in leading indicators such as PMI and IFO, production continued to fall by 5.3% y/y in October, weighed down by the still struggling car sector. Improving order book levels still leave a glimmer of hope for an easing of the industrial recession in Q4.

In the US we have several prominent FOMC members on the wire in Clarida, Williams, Bullard and Evans. Markets will look for confirmation that the Fed remains firmly on hold for now even if the global economic outlook has improved.

In the Scandies , the highlight is monthly Norwegian national accounts, see page 2.

Selected market news

Yesterday’s session proved a stabilisation in geopolitical concerns as the Iranian side emphasised that it does not seek war and President Trump downplayed the missile attack. The US clarification that the Iranian attacks had caused no casualties was important as it limits the risk of retaliatory measures that could trigger a full-blown war, which in our view is required for the conflict to have ramifications for the global economy. Trump did announce new sanctions on Iran but for markets this falls in the camp of possible retaliatory measures that indicate that the US is also backing away from an all-out conflict.

Equity markets rallied on the easing concerns with the major US benchmarks ending the day roughly 0.5% higher – even if stories of a rocket attack in Baghdad shortly before the US closing bell limited gains. Stories later clarified that no coalition troops or facilities had been hit by the two ‘small rockets’ and this morning most Asian equity benchmarks are solidly in green. The S&P500 future is marginally higher.

Easing tensions also triggered a rebound in USD rates , notably the market priced out about 5bp of a Fed rate cut this year, which in turn pushed the 12M EUR/USD FX forward higher. We still look for a 25bp rate cut in April, which is not fully priced.

Brent crude has dropped back below USD66/bbl and hence back down to the level before the Soleimani killing last Friday. In FX space the NOK has meanwhile rallied highlighting the old important point that it is the source behind oil price changes that determines the NOK FX impact. We believe in more NOK strength in the coming month. This morning we sent out our biweekly report on Norwegian markets.

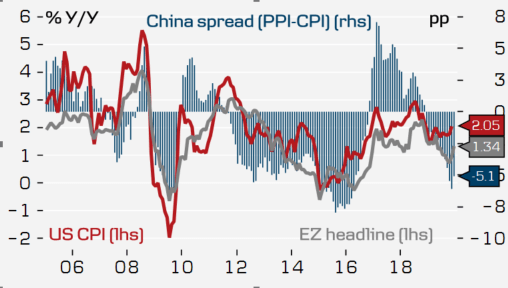

In China , inflation data overnight showed a slight setback in headline inflation to 4.5% y/y, while PPI remained entrenched in negative territory at -0.5% y/y. The spread – intuitively a proxy for corporate profits – hence still suggests that a negative inflation impulse is exported to the rest of the world as illustrated by this chart .