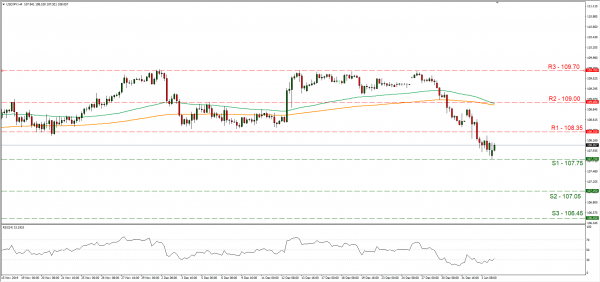

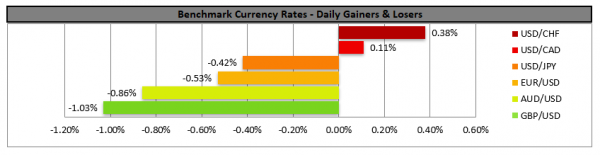

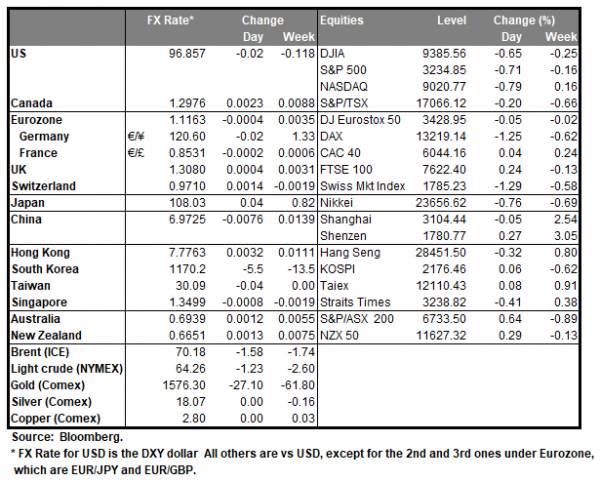

JPY strengthened as tensions in the middle east seem to widen after the assassination of two top Iranian military leaders by the US. Media in Iran stated that it will no longer abide to the nuclear deal terms about its capabilities to enrich uranium, increasing uncertainty in the area. It should be also be noted that according to media, the US stated that it had detected an increased state of alert by Iran’s missile forces and US President Trump warned of a major retaliation if Iran hit back. In a different development about the same issue, Iraq’s Parliament vot4ed for all foreign troops leave the country as the hit was made on Iraqi soil. Iran has vowed to respond the hit, hence further escalation could be expected, in which case safe havens such as gold and JPY could strengthen further and the same could apply for oil prices. USD/JPY briefly touched the 107.75 (S1) support line during today’s Asian session, as the pair tested a three month low. We could see the pair dropping further during the day as uncertainty seems to persist. On the other hand, we should note that the RSI indicator in the 4 hour chart has reached the reading of 30, confirming the bear’s dominance, yet at the same time may be implying also a possibly overcrowded short position for the pair. Should the pair remain under the selling interest of the market, we could see it breaking the 107.75 (S1) support line and aim for the 107.05 (S2) support level. Should the pair find fresh buying orders along its path, we could see it breaking the 108.35 (R1) resistance line and aim for the 109.00 (R2) resistance level.

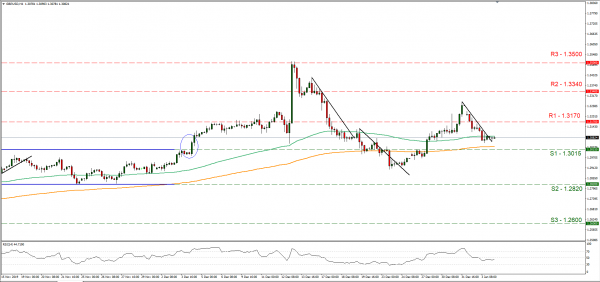

…while the pound seems to stabilise against the USD…

The pound weakened against the USD as uncertainty about a trade deal between the UK and the EU seems to continue to weigh. On the financial releases front the data did not do the pound any favours either, as economic activity in the construction sector seemed to contract even further in December. Also, it should be noted that last week a BoE survey showed that UK businesses did not expect Brexit uncertainty to be resolved until 2021. Analysts tend to note that should there be no fundamental improvement of the market sentiment, either from improved financial data or more confidence about a post Brexit trade deal of the UK with the EU we could see the pound weakening further. Cable slipped on Friday yet seems to have stabilised during today’s Asian session. As the pair’s price action, has broken the downward trendline incepted since the 31st of December, we switch our bearish outlook in favour of a side ways movement. Should the bears take control of the pair’s price action, we could see it breaking the 1.3015 (S1) support line and aim for the 1.2820 (S2) support level. Should on the other hand the pair come under the spell of the bulls, we could see it breaking the 1.3170 (R1) resistance line and aim for the 1.3340 (R2) resistance level.

Other economic highlights today and early tomorrow

Today we get a number of December PMIs from various countries, while in the European session, we get Germany’s retail sales growth rate for November, Eurozone’s Sentix Index for January, and producer prices growth rate for November. In the American session, we get Canada’s producer prices for November.

As for the rest of the week

On Tuesday, we get from the Eurozone the preliminary HICP rate for December and from the US the ISM Non-Mfg PMI for December. On Wednesday, we get from Germany the factory orders growth rate for November. On Thursday, we get China’s CPI for December and Germany’s industrial output growth rate for November. On Friday, we get Australia’s retail sales growth rate for November, the US employment report for December as well as Canada’s employment data for the same month..

Support: 107.75 (S1), 107.05 (S2), 106.45 (S3)

Resistance: 108.35 (R1), 109.00 (R2), 109.70 (R3)

Support: 1.3015 (S1), 1.2820 (S2), 1.2600 (S3)

Resistance: 1.3170 (R1), 1.3340 (R2), 1.3500 (R3)