2019 was a stellaryear for Gold investors and while the new yearmight not have the sameexplosive momentum that saw it gain nearly 20%at its peak earlier in 2019, another positive year for Gold prices is possible again. The precious metal at the time of writing remains 15% higher year-to-date despite a 5% drop since September, suggesting investors are still concerned over global growth as the new decade approaches.

Thaw in trade tensions boosts risk-on sentiment

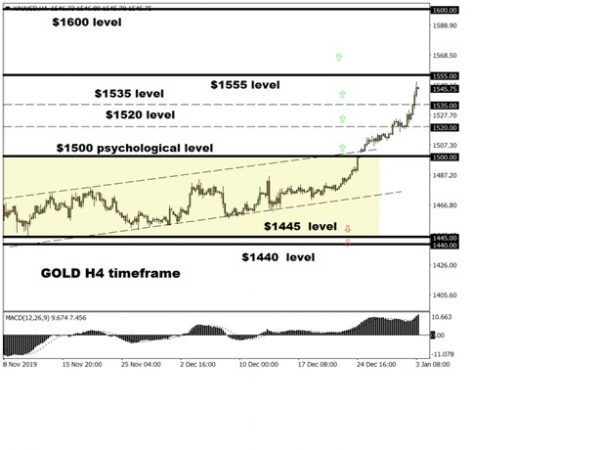

The improved US-China trade relations outlook is one reason why wecould seea near-term decline in Gold momentum. A narrow trading range between $1445 and $1500 has been in play since early November and further improvements in US-China trade relations, as well as a less pessimistic US Federal Reserve, could potentially encourage a decline in the precious metal through the lower part of the range. If there is a break below $1445, weakness towards $1400 for the first time since July 2019 is a possibility.

Although a phase one trade deal between US and China has been agreed and US Treasury Secretary Steven Mnuchin recently commented that it should be signed by early January, many trade issues remain and the agreement doesn’t significantly change the subdued global growth outlook going into 2020.

Weak global growth encourages gold bugs

The OECD recently warnedin November that world GDP for both 2019 and 2020 will be at the weakest levels seen since the global financial crisis. Even the succession of multiple record-highs in US stock markets do not seal over the cracks that are evident in the world economy. Moreover, the US-China trade dispute is protracted and ongoing with negotiations on the phase two deal yet to commence.

The Fed and Dollar outlook key for prices

Aside from prolonged US-China trade issues, there are other reasons to have a positive outlook on Gold.

The limitations in what ammunition central banks have left in the tank to combat weaker economic conditions couldprevent world stock markets from enjoying another stunning year. The current narrative provided by Fed Chair Jerome Powell that US interest rates will not increase soon is another potential bonus for Gold prices, considering that this should make the Greenback less attractive and Gold historically increases in value in times of Dollar weakness.

Gold investors should also take into account geopolitical factors before the November US election countdown begins by focusing on relations between the United States and North Korea. The latter recently made headlines by testing long-range missiles and suggesting a ’Christmas gift’ depending on the outcome of nuclear negotiations between Washington and Pyongyang.

Can Gold breakout of its current range?

The key psychological pivot level in gold prices will continue to be $1500, and potential buyers will likely wait for a confirmed move higher before being tempted into building long positions above this level. For as long as Gold stays below $1500, the range seen since November between $1500 and $1445 can continue.

In the event that Gold is able to successfully climb above $1500, more upside should be seen with resistance at $1520, $1535 and thenthe 2019 high at $1555 will be in sight.

A strong risk-averse environment due to an escalation in trade disputes could see Gold surpass $1555,with uncertaintyand negative market headlines pushingthe precious metal towards $1600 for the first time since 2013.