The price of crude oil jumped after the US killed Qassem Soleimani, a leader of the Iranian Islamic Revolutionary Guard (ISRG). Another leader, Abu Mahdi was also killed in the attack. These deaths are likely to start a new chapter in the rivalry between the United States and Iran. This comes shortly after an Iran-backed militia in Iraq stormed the US embassy. This came after the US retaliated against the killing of an American contractor. The price of oil rose because the market expects more geopolitical challenges in the Middle East.

The USD strengthened against the euro during the American session. This came after the US released last week’s jobless claims and PMI data. The initial jobless claims declined by 222k, which was better than the previous 224k. The continuing jobless claims increased to 1,728k, which was slightly higher than the previous 1,723k. Data from Challenger showed that the economy saw more than 32k job cuts in December. This was lower than the previous increase of 44.5k. Meanwhile, data from Markit showed that the manufacturing PMI declined from 52.6 to 52.4 in December.

The market will receive important economic data from Europe. In the United Kingdom, the Nationwide Building Society will release the house price index for December. Economists expect the data to show an annualized increase of 1.4%. This will be slightly better than the previous increase of 0.8%. Markit will release the preliminary PMI data from France, Germany, and other European countries. The German statistics office will release the unemployment rate and CPI data for December. In the United States, ISM will release the manufacturing PMI data.

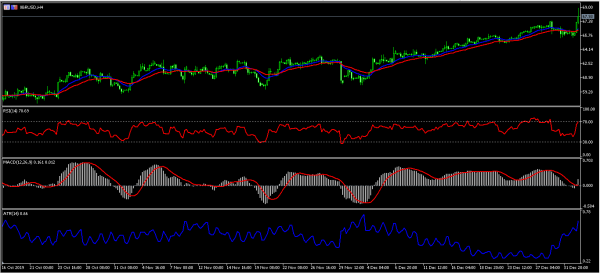

XBR/USD

The XBR/USD pair rose to a high of 68.92 in reaction to the new US attack in Iraq. This was the highest level since September 23 last year. The price is above the 14-day and 28-day moving averages. The RSI has moved to the overbought level of 70 while the signal line of the MACD has started declining. The Average True Range, which is a measure of volatility, has risen. The pair may remain volatile as tensions remain in the Middle East.

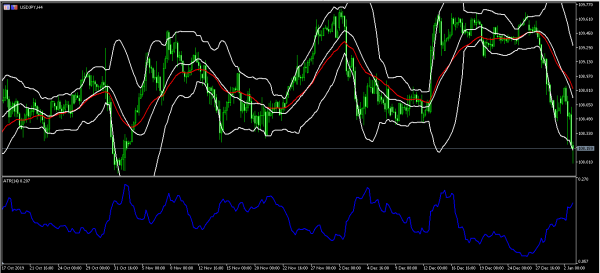

USD/JPY

The USD/JPY pair declined sharply in the Asian session. The pair reached a low of 108, which was the lowest level since October 31. This happened as traders moved to safety following the attack in Iraq. On the hourly chart, the price is below the 14-day and 28-day exponential moving averages. The price is along the lower line of the Bollinger Bands. The Average True Range has risen, which is a signal of increased volatility.

EUR/USD

The EUR/USD pair declined after data released yesterday. The pair reached a low of 1.1162, which is slightly below the 38.2% Fibonacci Retracement level. The pair has moved up a few pips, and is trading along the 38.2% Fibonacci level. The price is slightly below the 14-day and 28-day moving averages. The RSI has been moving lower, which is a signal that the price may continue moving lower.