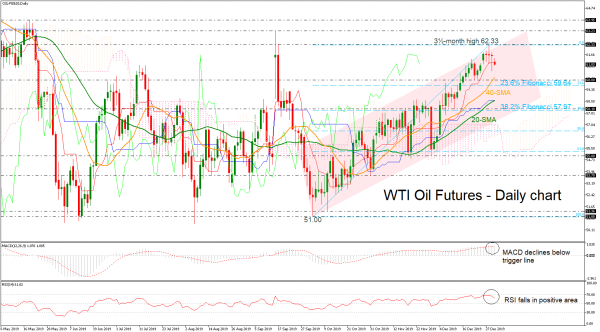

WTI oil futures for February delivery dived beneath the three-and-a-half-month high of 62.33 reached on December 30 and the momentum seems to be weak. The price has remained within a bullish wave since October and it touched the upper boundary several times over the last two weeks.

The location of the RSI, which maintains a negative slope below its 70 mark, keeps the very short-term bias in neutral-to-bearish territory. Moreover, the MACD oscillator declined below its red trigger line, suggesting a negative move, while the price dropped below the red Tenkan-sen line as well.

A downside reversal could initially stall near the 40-day simple moving average (SMA) and the 60.00 handle. Dipping below that floor, the 23.6% Fibonacci of the upward movement from 51.00 to 62.33 of 59.64 could come in defense to deter more declines towards the 20-day SMA, which coincides with the blue Kijun-sen line near 58.64. Still, a closing price below 58.00 could confirm that the downside correction will likely happen.

In the positive scenario, the price could improve above the three-and-a-half-month peak of 62.33 to challenge a stronger resistance around the 63.23 barrier, taken from the high of September 16 and the 63.95 resistance, identified by May 20.

In brief, oil paused the north-run in the medium term, while in the short term the interest turned to the negative if the markets fail to advance above 62.33.