Dollar is quite unfancied by the stronger than expected headline non-farm payroll number. NFP showed 222k growth in June versus expectation of 173k. Prior month’s figure was also revised up from 138k to 152k. However, unemployment rate rose 0.1% to 4.4%. And more importantly, average hourly earnings rose 0.2% mom versus expectation of 0.3% mom. Prior months wage growth was also revised down from 0.2% mom to 0.1% mom. EUR/USD spikes lower to 1.1388 but is quickly back at 1.1420. Nonetheless, USD/JPY is firm at around 113.70, but as supported by Yen’s weakness.

On the other hand, Canadian Dollar is gaining some momentum after its own job data. The employment market in Canada rose 45.3k in June, above expectation of 11.4k, not far from prior month’s 54.5k. Unemployment rate also dropped 0.1% to 6.5%. The job data is supportive to a rate hike by BoC next week.

UK data disappointed again

Meanwhile, Sterling tumbles sharply as production data from UK released today completed a string of weaker than expected data that raised doubts on the strength of the economy. Industrial production dropped -0.1% mom, -0.2% yoy in May versus expectation of 0.4% mom, 0.2% yoy. Manufacturing production dropped -0.2% mom, rose 0.4% yoy versus expectation of 0.4% mom, 0.9% yoy.

Construction output dropped -1.2% mom in May versus expectation of 0.6% rise. Trade deficit also widened to GBP -11.9b in May versus expectation of GBP -10.9B. BoE Governor Mark Carney said before that the committee will discuss on raising rate in the coming months. But if the outlook worsen, it’s believed the central bank will stay cautious, until at least when the picture for Brexit becomes clearer.

Also released from Europe today, German industrial production rose 1.2% mom in May versus expectation of 0.2% mom. Swiss unemployment rate rose 3.2% was unchanged at 3.2% in June. Swiss foreign currency reserves was relatively unchanged at CHF 639.5b in June.

BoJ announced emergency bond operation

In response to the this week’s surge in global bond yields, BoJ announced to carry out an emergency fixed-rate bond buying operation to curb long term yields under the so called "Yield Curve Control" framework. The central bank said it will buy unlimited amount of JGB with maturities of 5 to 10 years. This is the third time BoJ carries out such operations since the announcement of YCC last year. The first offer in November drew no bids. Under the second operation in February, JPY 723.9b in bonds were purchased.

Released from Japan, labor cash earnings rose 0.7% yoy in May, while real cash earnings rose 0.1% yoy. Leading index rose to 104.7 in May.

EUR/USD Mid-Day Outlook

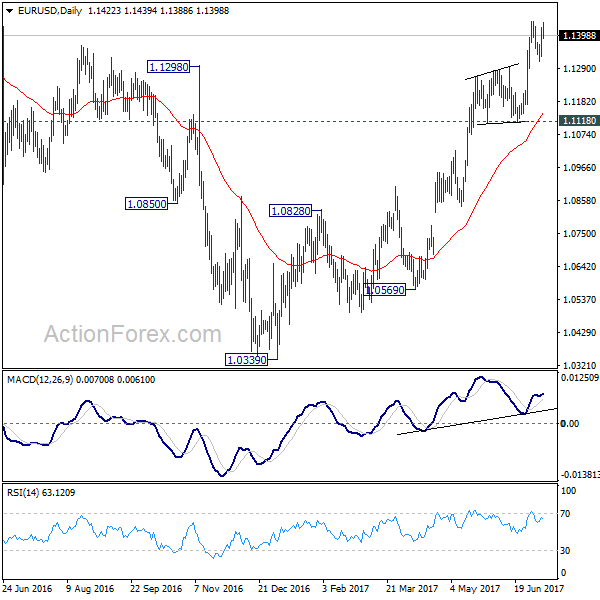

Daily Pivots: (S1) 1.1359; (P) 1.1392 (R1) 1.1454; More…..

Intraday bias in EUR/USD remains neutral for the moment with focus on 1.1444 resistance. Break there will resume whole rise from 1.0339 low and target 1.1615 resistance next. In case consolidation from 1.1444 extends with another fall, downside should be contained by 1.1291 resistance turned support to bring rally resumption. Meanwhile, break of 1.1291 will turn focus back to 1.1118 support instead.

In the bigger picture, the firm break of 1.1298 resistance further affirm medium term reversal. That is an important bottom was formed at 1.0339 on bullish convergence condition in weekly MACD. Further rise would be seen to 55 month EMA (now at 1.1776). Sustained break there will pave the way to 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 next. This will now remain the favored case as long as 1.1118 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | JPY | Labor Cash Earnings Y/Y May | 0.70% | 0.40% | 0.50% | |

| 00:00 | JPY | Real Cash Earnings Y/Y May | 0.10% | -0.10% | 0.00% | |

| 05:00 | JPY | Leading Index May P | 104.7 | 104.6 | 104.2 | |

| 05:45 | CHF | Unemployment Rate Jun | 3.20% | 3.20% | 3.20% | |

| 06:00 | EUR | German Industrial Production M/M May | 1.20% | 0.20% | 0.80% | 0.70% |

| 07:00 | CHF | Foreign Currency Reserves Jun | 693.5B | 695.0B | 693.7B | |

| 08:30 | GBP | Industrial Production M/M May | -0.10% | 0.40% | 0.20% | |

| 08:30 | GBP | Industrial Production Y/Y May | -0.20% | 0.20% | -0.80% | |

| 08:30 | GBP | Manufacturing Production M/M May | -0.20% | 0.40% | 0.20% | |

| 08:30 | GBP | Manufacturing Production Y/Y May | 0.40% | 0.90% | 0.00% | |

| 08:30 | GBP | Construction Output M/M May | -1.20% | 0.60% | -1.60% | -1.10% |

| 08:30 | GBP | Visible Trade Balance (GBP) May | -11.9B | -10.9B | -10.4B | -10.6B |

| 12:00 | GBP | NIESR GDP Estimate Jun | 0.20% | |||

| 12:30 | CAD | Net Change in Employment Jun | 45.3K | 11.4K | 54.5k | |

| 12:30 | CAD | Unemployment Rate Jun | 6.50% | 6.60% | 6.60% | |

| 12:30 | USD | Change in Non-farm Payrolls Jun | 222K | 173K | 138K | 152K |

| 12:30 | USD | Unemployment Rate Jun | 4.40% | 4.30% | 4.30% | |

| 12:30 | USD | Average Hourly Earnings M/M Jun | 0.20% | 0.30% | 0.20% | 0.10% |

| 14:00 | CAD | Ivey PMI Jun | 53.8 | |||

| 14:30 | USD | Natural Gas Storage | 46B |