- Headline CPI rose to 2.2% y/y in November, a six-month high

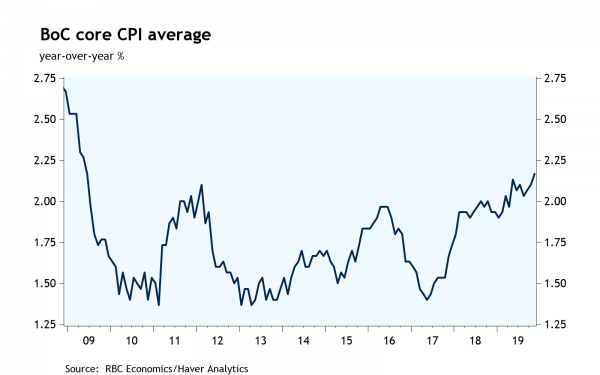

- BoC’s core CPI measures averaged a cycle-high 2.2%

- Energy price growth back into positive territory

The jump in headline inflation in November was mostly due to base effects, with energy prices having fallen sharply toward the end of 2018. Inflation should remain above 2% until that decline washes out of the year-over-year calculation (we think around March 2020). That said, there is growing evidence of (an admittedly modest) firming in underlying inflation trends. The BoC’s core measures averaged 2.2% in November, the strongest pace in a decade. And prices for goods excluding food and energy are growing at their fastest rate since a currency-driven increase in 2015-16.

Consumers can be forgiven for thinking prices are rising even faster than the headline rate suggests. Prices for food purchased from stores have been growing at 4% for the last six months. Households will also be feeling an increase in debt servicing costs, which according to data last week hit a record high in Q3. For some highly indebted borrowers, that won’t be fully reflected in the shelter component of CPI, despite its inclusion of mortgage interest costs which are up 6.6% year-over-year.

We don’t think today’s inflation data ties the Bank of Canada’s hands. Policymakers will likely be more influenced by next week’s October GDP report, which we think will set up for another quarter of sub-trend growth in Q4. That should leave the door open to a rate cut next year, even with underlying inflation now on the high side of 2%.