Yen tumbles broadly as global bond rout continued and pushed yields higher again. German 10 year bund yields broke 0.5% level for the first time since January 2016. Meanwhile, US 10 year yield jumped to a near two month high and closed firmly at 2.37, up 0.036. The resumed selling in bonds were believed to be triggered by the hawkish ECB minutes which indicated the discussion of removing easing bias. Also, some believed that weak results of French 30 year bond-auction was another trigger. UD/JPY reaches as high as 113.83 as recent rise resumed. GBP/JPY also hits as high as 147.60. Meanwhile, EUR/JPY is even stronger and hits 129.91, set to take on 130 handle.

In response to the developments, BoJ announced to carry out an emergency fixed-rate bond buying operation to curb long term yields under the so called "Yield Curve Control" framework. The central bank said it will buy unlimited amount of JGB with maturities of 5 to 10 years. This is the third time BoJ carries out such operations since the announcement of YCC last year. The first offer in November drew no bids. Under the second operation in February, JPY 723.9b in bonds were purchased.

Yen follows yield, not stocks

We’ve pointed out before that Yen is decoupling from risk aversion and its now more correlated to yields. This is clearly seen again as global equities tumbled overnight. DOW lost -158.13 pts, or -0.74% to 21320.04. S&P 500 dropped -22.79 pts, or -0.94% to 2409.75. NASDAQ closed down -61.40 pts, or -1.0% at 6089.46. NASDAQ stays the more vulnerable one as last week’s low was breached. Weakness carries on in Asia with Nikkei trading down -0.3% and broke 20000 handle at the time of writing. FTSE and DAX might set to take on last week’s low at 7302.7 and 12319 respectively.

Euro boosted by hawkish ECB accounts

For the week so far, Euro is the second strongest major currency, behind Dollar by a thin margin. And yesterday’s rebound in EUR/USD could actually be setting up for a break through 1.1444 resistance today. The minutes for the June ECB meeting turned out more hawkish than expected. The minutes unveiled that policymakers had discussed removing the guidance on the bond asset purchase program (QE), if necessary. Policymakers just shrugged off recent weakness in headline inflation as core inflation continued to climb higher. This came in line with President Mario Draghi’s comments last week that "deflationary forces have been replaced by reflationary ones", pointing to a "strengthening and broadening recovery" in the Eurozone. More in June’s Minutes Revealed ECB Discussed over Removing Asset Purchases Guidance, Euro Soars

NFP expectations setting up for downside surprise

Non-farm payroll report from US will be the main focus today. Economists expect 173k growth in the job market in June, with unemployment rate unchanged at 4.3%. Average hourly earnings are expected to show 0.3% mom growth. Looking at other related data, ADP private payroll was a disappointment with only 158k growth. Employment component of ISM services dropped from 57.8 to 55.8. But employment component of ISM manufacturing jumped sharply from 53.5 to 57.2. Four week moving average of initial jobless claims was relatively unchanged at 243k while continuing claims stayed below 2m level. Conference board consumer confidence improved slightly to 118.9. The data point to a solid NFP report today, which on the other hand, could be seen as a setup for a downside surprise.

Also on the data front, Japan labor cash earnings rose 0.7% yoy in May, while real cash earnings rose 0.1% yoy. UK production data will be the main focus in European session, where trade balance will also be released. Germany will release industrial production too. Swiss will release unemployment and foreign currency reserves. Later in the day, in additional to US NFP, Canada will also release employment data and Ivey PMI.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 128.40; (P) 128.90; (R1) 129.82; More…

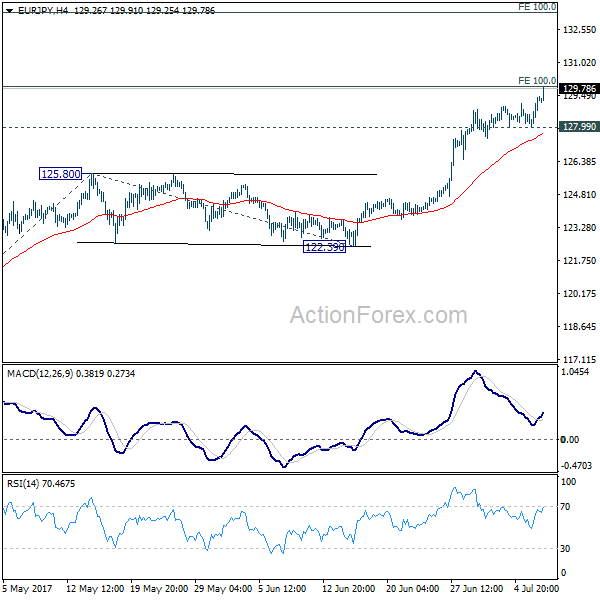

EUR/JPY’s rally extends and reaches as high as 129.91 and there is no sign of topping yet. Firm break of medium term projection level at 128.89 will pave the way to next near term projection level at 100% projection of 114.84 to 125.80 from 122.39 at 133.35. On the downside, break of 127.99 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

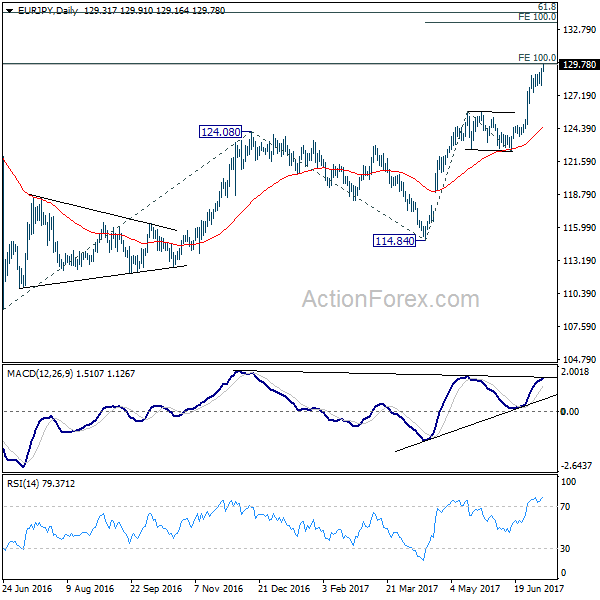

In the bigger picture, the break of 126.09 support turned resistance should have confirmed completion of down trend form 149.76 (2014 high), at 109.03 (2016 low). Current rise from 109.03 has already met target of 100% projection of 109.03 to 124.08 from 114.84 at 129.89. Sustained break there will pave the way to 61.8% retracement of 149.76 to 109.03 at 134.20 and above. Medium term outlook will now remain bullish as long as 122.39 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:00 | JPY | Labor Cash Earnings Y/Y May | 0.70% | 0.40% | 0.50% | |

| 0:00 | JPY | Real Cash Earnings Y/Y May | 0.10% | -0.10% | 0.00% | |

| 5:00 | JPY | Leading Index May P | 104.6 | 104.2 | ||

| 5:45 | CHF | Unemployment Rate Jun | 3.20% | 3.20% | ||

| 6:00 | EUR | German Industrial Production M/M May | 0.20% | 0.80% | ||

| 7:00 | CHF | Foreign Currency Reserves Jun | 695.0B | 693.7B | ||

| 8:30 | GBP | Industrial Production M/M May | 0.40% | 0.20% | ||

| 8:30 | GBP | Industrial Production Y/Y May | 0.20% | -0.80% | ||

| 8:30 | GBP | Manufacturing Production M/M May | 0.40% | 0.20% | ||

| 8:30 | GBP | Manufacturing Production Y/Y May | 0.90% | 0.00% | ||

| 8:30 | GBP | Construction Output M/M May | 0.60% | -1.60% | ||

| 8:30 | GBP | Visible Trade Balance (GBP) May | -10.9B | -10.4B | ||

| 12:00 | GBP | NIESR GDP Estimate Jun | 0.20% | |||

| 12:30 | CAD | Net Change in Employment Jun | 54.5k | |||

| 12:30 | CAD | Unemployment Rate Jun | 6.60% | |||

| 12:30 | USD | Change in Non-farm Payrolls Jun | 173K | 138K | ||

| 12:30 | USD | Unemployment Rate Jun | 4.30% | 4.30% | ||

| 12:30 | USD | Average Hourly Earnings M/M Jun | 0.30% | 0.20% | ||

| 14:00 | CAD | Ivey PMI Jun | 53.8 | |||

| 14:30 | USD | Natural Gas Storage | 46B |