Dollar is under some pressure in early US session after disappointing job data. On the other hand, Euro surged broadly as market perceived the ECB monetary policy account as a hawkish one. US ADP employment report showed 158k growth in private sector jobs in June, below expectation of 180k. Prior month’s figure was revised down to 230k, from 253k. Initial jobless claims rose 4k to 248k in the week ended July 1, versus consensus of 243k. The number, nonetheless, remain historically low and stayed below 300k handle for the 122 straight weeks. Continuing claims rose 11k to 1.96m in the week ended June 24, staying below 2m for 12 straight weeks. Also released in early US session, US trade deficit narrowed to USD -46.5b in May. Canada trade deficit widened to CAD -1.1b in May. Canada building permits rose 8.9% mom in May.

Quick update: Dollar stays soft despite upside surprise in ISM services

FOMC minutes for June meeting released yesterday showed that policy makers were divided over the timing of balance sheet reduction while there was also discussion over the recent inflation weakness."Several participants indicated that the reduction in policy accommodation arising from the commencement of balance sheet normalization was one basis for believing that, if economic conditions evolved broadly as anticipated, the target range for the federal funds rate would follow a less steep path than it otherwise would". Yet, "some other participants suggested that they did not see the balance sheet normalization program as a factor likely to figure heavily in decisions about the target range for the federal funds rate". More in FOMC Members Divided over Balance Sheet Reduction Schedule.

ECB considered dropping pledge of expanding QE

ECB’s monetary policy accounts showed that during the meeting on June 7-8, policy makers discussed dropping the pledge to expand its quantitative easing program if necessary as "the economic expansion proceeded and if confidence in the inflation outlook improved further." And, "gradual adjustments in the governing council’s communication…would be in line with the evolving risk assessment." But for the moment, "there was broad agreement among members that the current monetary policy stance remained appropriate" given the subdued inflation.

ECB chief economist Peter Praet repeated his urge that the central bank needs "patience and persistence" as "our mission is not yet accomplished." Praet acknowledged broadening economy recovery but underlying inflation remained too low. And he emphasized that "maintaining a steady hand continues to be critical to fostering a durable convergence of inflation toward our monetary policy aim."

Released in Europe today, Eurozone retail PMI rose to 53.2 in June. German factory orders rose 1.0% mom in May. Swiss CPI slowed deeply to 0.2% yoy in June, down from 0.5% yoy.

Australia trade surplus widened

From Australia, trade surplus widened to AUD 2.47b in May, up from AUD 0.09b and beat expectation of AUD 1.11b. That was driven by the 9% growth in exports over the month while imports rose 1%. However, it should be noted that coal exports jumped 62% over the month, for supply was disrupted back in April after Queensland was hit by cyclone in late March. Aussie remains the weakest major currency for the week as markets were dissatisfied that RBA didn’t turn hawkish, following other major central banks.

IMF Lagarde: Financial vulnerabilities present an immediate concern

IMF Managing Director Christine Lagarde warned in a blog post that "financial vulnerabilities present an immediate concern." And, "after a long period of favorable financial conditions, including low-interest rates and easier access to credit, corporate leverage in many emerging economies is too high." In Europe, she noted that "bank balance sheets still need repair following the crisis." In China, "a faster-than-projected expansion – if it continues to be fueled by rapid credit and increased spending – would potentially lead to unsustainable public and private debt in the future".

EUR/USD Mid-Day Outlook

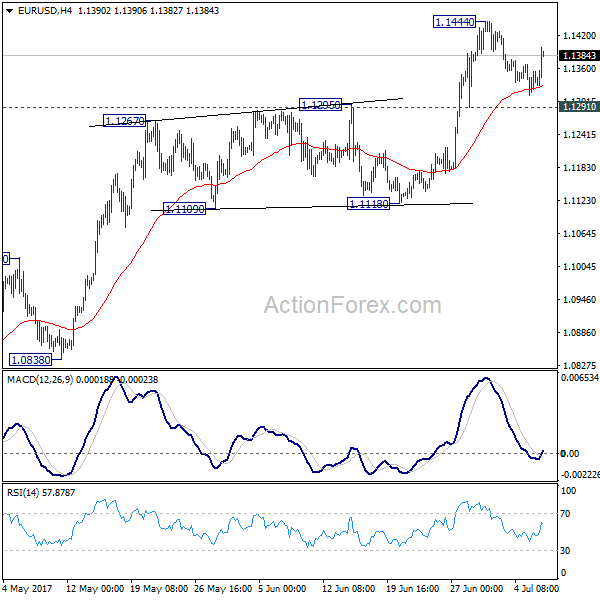

Daily Pivots: (S1) 1.1319; (P) 1.1344 (R1) 1.1375; More…..

EUR/USD rebounds strongly after drawing support from 4 hour 55 EMA. But it’s staying in range below 1.1444 and intraday bias remains neutral first. In case of another fall, we’d expect downside to be contained by 1.1291 resistance turned support to bring rally resumption. Break of 1.1444 will extend the rise from 1.0339 low to 1.1615 resistance next. Meanwhile, break of 1.1291 will turn focus back to 1.1118 support.

In the bigger picture, the firm break of 1.1298 resistance further affirm medium term reversal. That is an important bottom was formed at 1.0339 on bullish convergence condition in weekly MACD. Further rise would be seen to 55 month EMA (now at 1.1776). Sustained break there will pave the way to 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 next. This will now remain the favored case as long as 1.1118 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) May | 2.47B | 1.11B | 0.56B | 0.09B |

| 06:00 | EUR | German Factory Orders M/M May | 1.00% | 1.80% | -2.10% | -2.20% |

| 07:15 | CHF | CPI M/M Jun | -0.10% | 0.00% | 0.20% | |

| 07:15 | CHF | CPI Y/Y Jun | 0.20% | 0.30% | 0.50% | |

| 08:10 | EUR | Eurozone Retail PMI Jun | 53.2 | 52 | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Jun | -19.30% | 9.70% | ||

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:15 | USD | ADP Employment Change Jun | 158K | 180K | 253K | 230K |

| 12:30 | CAD | Building Permits M/M May | 8.90% | 2.60% | -0.20% | |

| 12:30 | CAD | International Merchandise Trade (CAD) May | -1.1B | -0.5B | -0.4B | |

| 12:30 | USD | Trade Balance May | -46.5B | -46.3B | -47.6B | |

| 12:30 | USD | Initial Jobless Claims (JUL 01) | 248K | 243K | 244K | |

| 14:00 | USD | ISM Services/Non-Manufacturing Composite Jun | 57.4 | 56.5 | 56.9 | |

| 15:00 | USD | Crude Oil Inventories | 0.1M |