This morning Britain started voting. The results of the General Elections are important not only in the United Kingdom but around the world. Markets want to know who will win and how the “endless Brexit” story ends. The results of the vote will show whether Boris Johnson will receive a “green light” from the electorate for a British exit from the EU.

Elections will be held in 650 districts, and the same number of seats in the House of Commons. To get the majority, the party will need to win 326 seats. Surveys point to the victory of Tory, although the preponderance has been steadily decreasing as the election date approaches. Clearly, even a slight change in voters’ sentiment can change the entire balance of power.

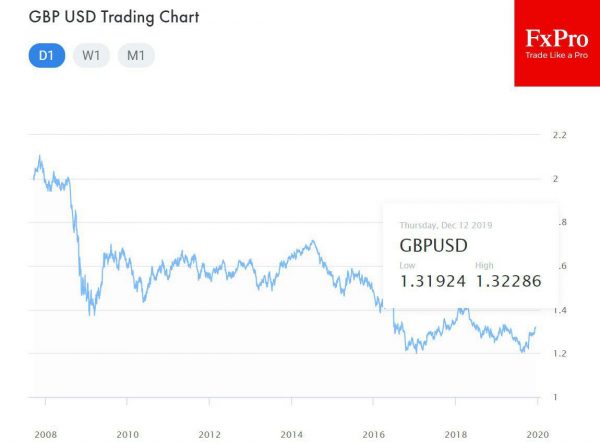

It should be noted that the pound had a long way since the country’s decision to exit from the EU. The British currency collapsed from $1.5 to $1.1450 after the vote, then bounced back to $1.3 amid hopes for controlled Brexit. Therefore, it is obvious that the results of the elections are crucial for the price dynamics of GBP at the moment. In the case of a negative scenario, the sterling price may decline to $1.26, while in the opposite situation, the growth can be more modest, reaching $1.34.

Meanwhile, the US Federal Reserve left the interest rate unchanged on Wednesday night, which was clearly helped by the strong employment data released last week. Jerome Powell’s comments on the economy also clearly indicate that the Central Bank does not plan any significant adjustments until there are no significant threats to the economy. Moreover, the head of the Federal Reserve is confident that the labor market has room for growth. As expected, following the optimistic statements, the stock market has started to show an upward trend.

The second most important event in the world of monetary policy with the potential for a significant impact on the global economy is today’s ECB meeting, the first one chaired by Christine Lagarde. In this case, market participants also do not expect rate changes. The main focus will be on Lagarde’s comments on the assessment of the economic situation, as well as on the announcement of possible actions in case the situation gets out of control.

Besides ECB, on Thursday the decision will be announced by the Swiss National Bank (SNB), which is expected to keep the policy unchanged, and, therefore, the rates will continue to be negative. The Turkish central bank will also decide on the rates, which may put pressure on the lira.

This week will also be remembered for the hopes of concluding the first phase of the trade deal and postponing the introduction of tariffs. Anyway, traders with positions in the Chinese yuan expect such a scenario. And the higher the expectations, the more disappointed they can be: there is a possibility that the trade war may last more than a year. The current fluctuations in different directions, as well as speculations about delays and “progress in negotiations” indicate that there is still little political will to make a deal. We all see that when the parties really need to resolve an important issue, the solution is quick and constructive. Apparently, this is not the case.