The USD weakened after a series of negative data and information from the United States. Yesterday, Donald Trump said that the US would add new tariffs on steel and aluminium from Argentina and Brazil. Trump blamed the two countries of undervaluing their currencies to take advantage of the US in the agricultural sector. In addition, the Trump administration proposed a 100% tariff on goods from France over the digital tax that was announced a few months ago. Meanwhile, data from the Institute of Supply Management (ISM) showed that the sector was contracting. The PMI came in at 48.1, which was lower than the previous 48.3. This was the fourth straight month of contraction.

The Australian dollar rose slightly after the central bank left interest rates unchanged at 0.75%. This was in line with what the market was expecting. In the accompanying statement, Governor Philip Lowe said that the Australian economy appears to have reached a turning point. He expects the economy to pick up gradually to around 3% in 2021. He cited the low interest rates, recent tax cuts, ongoing spending on infrastructure, rising housing prices, and an improving resource sector. He also expects the unemployment rate to remain around 5.25% and drop to around 5% in 2021. As a result, the board decided to leave rates unchanged at 0.75%.

The market will keep an eye on the ongoing trade tussles as the US starts new battles with Europe and South America. These countries will likely announce their countermeasures today. Other data that will be watched will be the UK construction PMI, Spain’s unemployment rate, Switzerland’s CPI, US Redbook, and Brazil GDP. The UK manufacturing PMI is expected to improve slightly from 44.2 to 44.5, while Swiss headline CPI is expected to improve slightly from -0.3% to -0.1%.

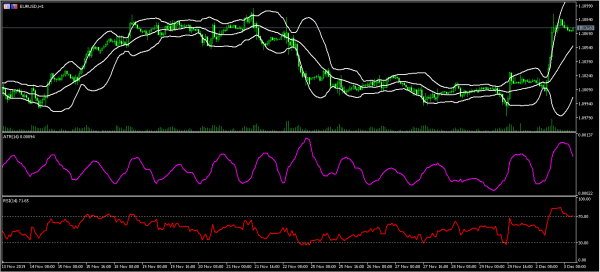

EUR/USD

The EUR/USD pair, which was consolidating previously, made an upward breakout yesterday. The price jumped from a low of 1.1000 to a high of 1.1090. This was the highest level since November 22. The Bollinger Bands have widened while ATR has jumped. This is a signal that there is volatility in the market. The RSI remains above the overbought level. The pair may continue being this volatile as the market waits for employment data from the United States.

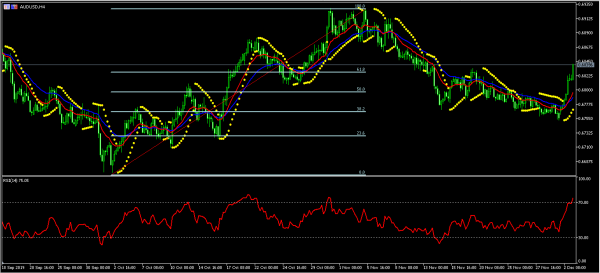

AUD/USD

The AUD/USD pair rose after the positive statement from the Australian central bank. The pair reached a high of 0.6840, which was the highest level since November 13. On the four-hour chart, the price is above the 61.8% Fibonacci Retracement level. The price is also slightly above the 14-day and 28-day moving averages while the RSI has moved to the overbought level. The dots of the Parabolic SAR are below the price. This is an indication that the pair may continue moving higher.

NAS100

The Nasdaq index pared back earlier gains and dropped sharply after the Trump administration announced new tariffs. This price action happened shortly after the index made a double top pattern at the $8454 level. It dropped to a low of $8273 and is now trading at $8333. The price is along the 14-day moving averages and slightly below the 28-day EMA. The index may remain being volatile today as traders react to the new trade wars. Also, the market will start receiving important tech corporate earnings.