U.S. Highlights

- A quiet, holiday-shortened week featured data that painted a picture of an economy that has slowed, but not stalled. Revisions to Q2 GDP did little to change the picture of the economy.

- Durable goods orders were a bright spot, but the Fed’s manufacturing surveys continue to point to a lack of confidence on investment spending. The Beige Book echoed this two-speed view of struggles in the factory sector, and health elsewhere.

- The consumer remains an area of strength, with spending on track to put in a solid performance in Q4, helped by healthy advances in wages and salaries and benign inflation.

Canadian Highlights

- The main event this week was Friday’s third quarter GDP report. Economic activity rose 1.3%, a deceleration from the prior quarter that masked more encouraging details.

- Early indicators for the final quarter of 2019 suggest another modest expansion is in store. Falling confidence and disruptions in several key sectors will act as headwinds to expansion.

- The Bank of Canada will be content to hold its key policy rate unchanged on Wednesday as recent economic trends remain effectively unbroken.

U.S. – Something To Be Thankful For

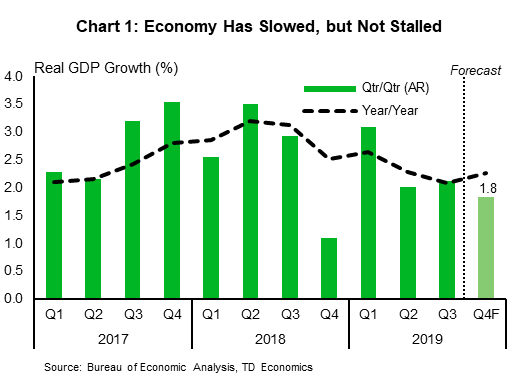

A relatively quiet, holiday-shortened week featured data that painted a picture of an economy that has slowed, but not stalled. Revisions to Q3 economic growth were uneventful. Headline GDP growth was revised up from 1.9% annualized to 2.1%, largely owing to a build-up in inventories. Rising inventories are not typically a sign of economic strength, so we don’t view that slight upward boost as changing the picture in a meaningful way.

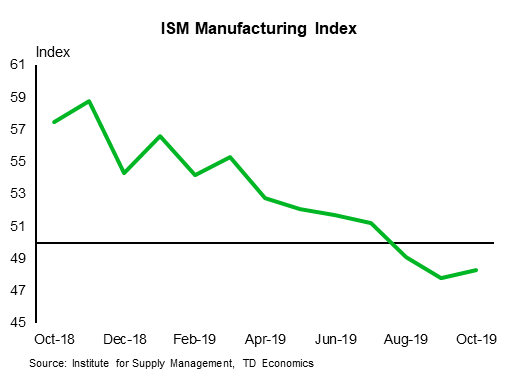

Final domestic demand was 2% in Q3, after averaging 2.7% in the first half of the year, and 3% in 2018. That is the narrative right there. The economy has slowed from a robust pace to a moderate pace, very close to what we consider its underlying “trend”(Chart 1). The Fed’s latest Beige Book indicated that this tempo has likely continued this quarter. It characterized economic activity as progressing at a modest pace through most districts, unchanged relative to the prior report. Consumer related sectors, including residential construction, are doing well, while ongoing struggles in the manufacturing sector continued.

Durable goods orders for October painted a slightly better picture. Nondefense capital goods orders ex-aircraft, a key signpost to business investment, had a solid gain for the first time in a few months. It wasn’t enough to change our view of manufacturing weakness, but it did support an upgrade to expectations for equipment spending in Q4. Overall, we expect business investment to advance roughly 2.4%, ending two quarters of contraction. However, this does not entirely lift the damper uncertainty is having on investment. Looking at the regional Fed manufacturing surveys, the capital expenditures components on the whole weakened further in November, so we don’t believe business spending or the manufacturing sector is out of the woods yet.

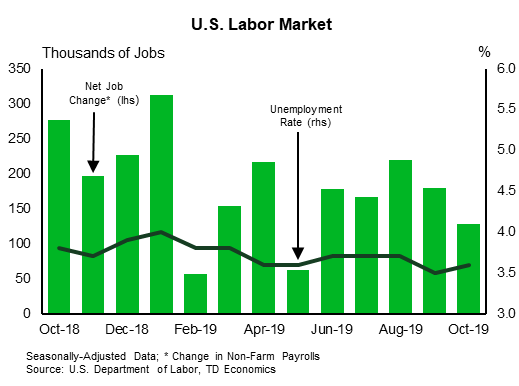

On the plus side, the October personal spending data suggests that the consumer is looking solid at the start of the fourth quarter. Barring a confidence-sapping event, we expect consumer spending to come in around 2.4%, in line with our September forecast. The gray cloud in the October data was a drop in real personal disposable income. However, that seems to have been due to a decline in farm incomes, after a sizeable boost from government payouts to compensate farmers for tariff-related damages. Wages and salaries still rose 0.4% on the month, and was up 4.9% versus a year ago (nominal terms) – a pretty healthy pace, particularly when overlaid on the benign inflation backdrop.

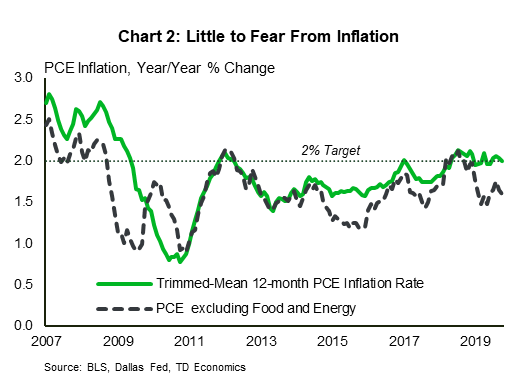

The Fed’s preferred inflation measure – the core PCE deflator – rose only 0.1% in October (Chart 2). The Dallas Fed’s trimmed mean (which strips out price volatility more broadly than food and energy) has been steady at the Fed’s 2% target for a few months. There’s little on the inflation front to spook the Fed to either cut or raise interest rates any time soon. Early in the week, Chair Powell highlighted the benefits of extending the current economic cycle – mainly that lower income households have not yet regained the wealth lost in the great recession. Strong labor markets are finally starting to spark healthy wage gains for lower-income workers, which spreads the gains from a strong economy more broadly. Amid all the trade gloom and uncertainty, that is something to be thankful for.

Canada – Solid End To A Quiet Week

It was a relatively quiet week in financial markets as U.S. traders took their Thanksgiving break. The TSX looked set to end the week a tiny bit higher at the time of writing, while the loonie sat close to where it started the week. There was a bit more excitement on the politics front. This week saw some signs of progress towards getting the Canada-U.S.-Mexico (CUSMA) trade deal officially on the books. Deputy PM Freeland and her Mexican counterpart were in Washington this week, reportedly to assess potential labour-related tweaks to the agreement. The path to full ratification of this deal has been a bumpy one. Getting it officially on the books would finally remove at least one source of uncertainty for manufacturers and exporters.

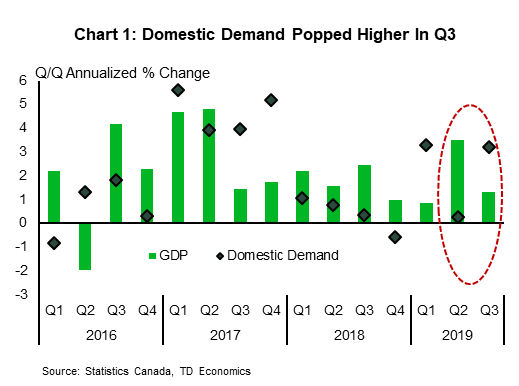

Turning to the economic data, this week’s calendar was dominated by Friday’s third quarter GDP release. The report was a pleasant surprise. At 1.3% quarterly annualized growth, the headline came in a bit ahead of our expectations, and the details were even better (Chart 1). Final domestic demand rose a robust 3.2% as almost every major category rose. This quarter also brought Statistics Canada’s major revisions, where they incorporate important, but lagged data, such as tax returns. These revisions suggested a more resilient economy than thought. Among the positive revisions were slightly stronger business investment, notably on non-residential structures, and a higher household savings rate than previously reported.

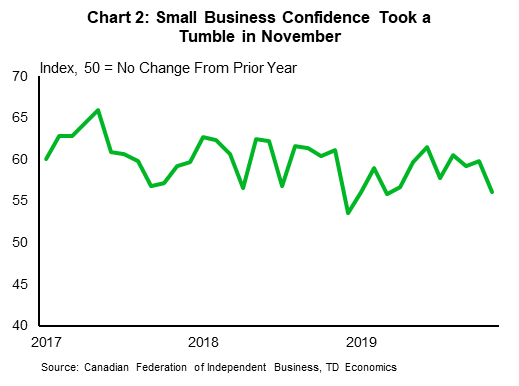

Looking ahead to the close of the year, early signs point to a similar headline performance, although perhaps with softer details. Small business confidence dropped markedly in November (Chart 2). Driven lower by Alberta and Saskatchewan, the early read suggests that another quarter of lukewarm overall activity is likely. Reinforcing this view are a number of one-off surprises affecting key sectors. The U.S. GM strike affected their Canadian operations and should show up as a headwind to the manufacturing sector early in the quarter. More recently, the now-resolved labour disruption at CN Rail was thankfully shorter than we anticipated. However, with eight days of disruption in an industry where opportunities for ‘catch up’ growth are limited – there are only so many trains/cars/lines – we still expect a modest (0.1 percentage point) drag on the quarter as a result.

This brings us to the next big event: this coming Wednesday’s Bank of Canada interest rate decision. Holding the overnight interest rate at 1.75% is pretty much a foregone conclusion. Why? The Bank has already pencilled in a soft end to 2019, forecasting 1.3% growth in both Q3 and Q4 in their October Monetary Policy Report, and will likely be pleasantly surprised by the details of the GDP data, especially the strength in business investment. What’s more, recent speeches have emphasized the financial stability risks in the Canadian economy. The bar to easing is clearly higher than in the past, but it is not stratospheric. Should consumer spending or housing take a tumble, or financial conditions tighten rapidly, the narrative would quickly change. But, with the final rate decision of 2019 right around the corner, that will have to be a 2020 story.

U.S: Upcoming Key Economic Releases

U.S. ISM Manufacturing Index – October

Release Date: December 2, 2019

Previous: 48.3

TD Forecast: 49.2

Consensus: 49.5

We look for the ISM manufacturing index to continue to recover in November, rising to 49.2 from 48.3 given recent optimism on trade discussions and the firming of some regional surveys, including Chicago and Philadelphia. On the contrary, and largely reflecting a recent moderation in consumer spending, we look for a modest decline in the non-manufacturing index to a still firm 54.5 following last month’s 2pt gain to 54.7.

U.S. Employment – November

Release Date: December 6, 2019

Previous: 128k, unemployment rate: 3.6%

TD Forecast: 200k, unemployment rate: 3.5%

Consensus: 190k, unemployment rate: 3.6%

We expect nonfarm payrolls to increase by 200k in November, following the above-consensus 128k October print. Jobs in the goods sector should have rebounded to 50k following last month’s large decline due to the GM strike; employment in motor vehicle production fell by 41k in October before workers ratified a new deal on October 25th. The household survey should show the unemployment rate ticked down to 3.5%, matching the multi-decade low from August, while we expect wages to rise 0.3% m/m, leaving the annual rate unchanged at 3.0% y/y.

Canada: Upcoming Key Economic Releases

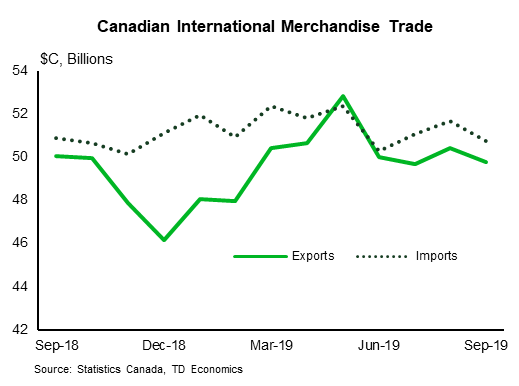

Canadian International Trade – October

Release Date: December 5, 2019

Previous: -$0.98bn

TD Forecast: -$2.0bn

Consensus: NA

The international trade deficit is forecast to widen to $2.0bn in October owing to a sizeable drag from motor vehicle exports. The UAW strike and ensuring parts shortage weighed heavily on Canadian vehicle production, and preliminary figures show a pullback in line with the 6% m/m drop in US auto imports. This should contribute to a broader decline in export activity, with forestry products expected to edge lower in response to reduced activity at lumbermills, while lower oil prices will also act as a headwind to nominal exports. Imports should see a more modest decline consistent with softer US exports and sluggish domestic demand.

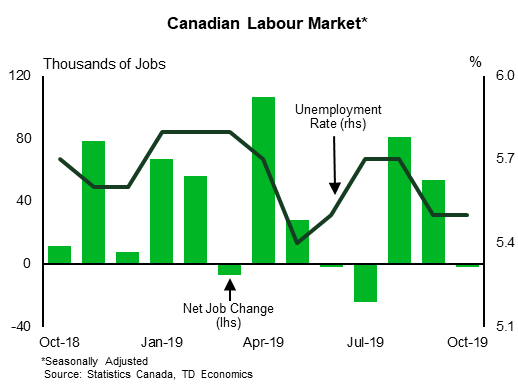

Canadian Employment – November

Release Date: December 6, 2019

Previous: -2k, unemployment rate: 5.5%

TD Forecast: -10k, unemployment rate: 5.6%

Consensus: NA

TD looks for the labour market to underwhelm with a 10k decline in employment for November, driven by a unwind of election-related hiring after public administration employment rose by 20k in October. Financial sector employment, currently running at +5.5% y/y, also looks prime for some giveback after a 17k increase last month while unseasonably cool weather will weigh on construction hiring. On the other end of the spectrum, manufacturing employment should rebound from a 23k drop after the resolved UAW strike allowed Canadian workers to return to the job, however, this could be partially offset by the scheduled winddown of GM’s Oshawa plant. Should our forecast prove accurate the 6m trend would slip from 22k to 16k, the softest pace since mid-2018, with declines in four of those six months. This would push the unemployment rate back to 5.6%, assuming modest labour force growth, while muted base-effects should see wage growth hold at 4.4% y/y.