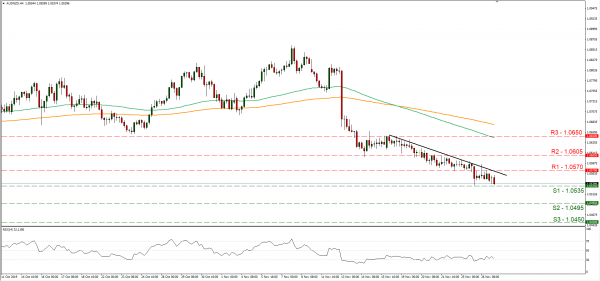

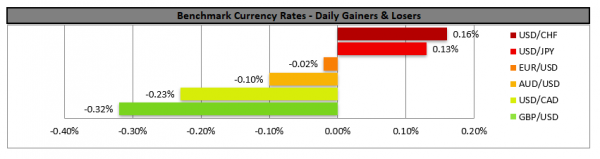

The NZD continued to strengthen against the AUD yesterday slowly but steadily as the central bank differentials of the two countries continued to support it. The Aussie initially got a boost from RBA governor Lowe’s speech where he started by stating that QE was not on RBA’s agenda. Later on though, the RBA governor practically opened the door for the bank to lower its rates as low as +0.25%, before employing a QE program, which if employed by RBA would be for Government bonds and not the private sector. The market prices in a rate cut in February by 60.7%, yet analysts are less optimistic expecting two rate cuts until June 2020 and a QE program for RBA. On the flip side RBNZ refrains from any action and at his press conference overnight, RBNZ governor avoided any comments on monetary policy. We expect central bank differentials and financial data to continue to feed the pair’s direction in the near term. AUD/NZD continued its drop yesterday and tested the 1.0535 (S1) support line during today’s Asian session. We maintain a bearish outlook for the pair, as the downward trendline incepted since the 18th of the month remains intact. Should the bears maintain control over the pair we could see it breaking the 1.0535 (S1) support line and aim for the 1.0495 (S2) support level. On the flip side should the bulls dictate the pair’s direction, we could see the pair breaking the 1.0570 (R1) resistance line and aim for the 1.0605 (R2) resistance hurdle which served the pair faithfully on the 21st of the month.

…while no news on the US-Sino front, before Thanks-giving…

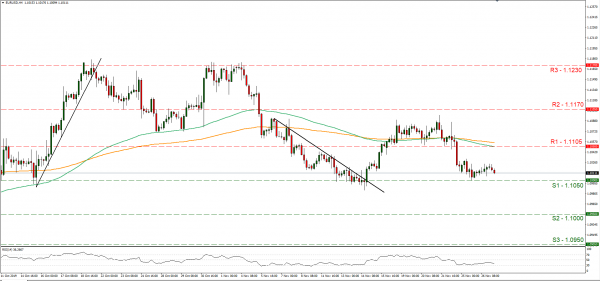

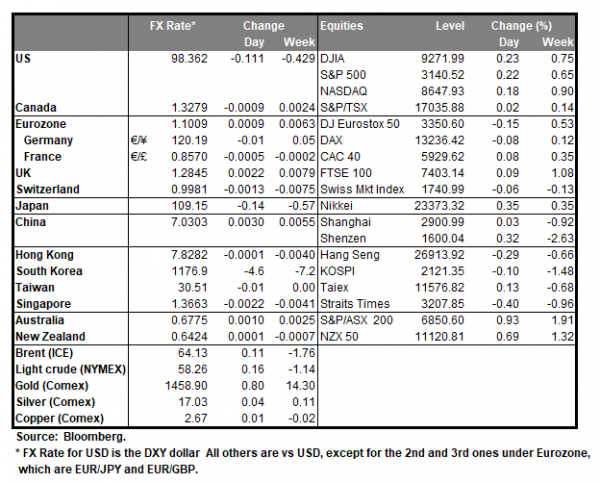

The market seems to remain in a wait and see position regarding the US-Sino trade war developments as little movement was evident yesterday. President Trump stated on Tuesday that the US was in the “final throes” of reaching a trade deal with China, yet the FX market seemed little impressed. At the same time, he also repeated Washington’s support for the Hong Kong protests. Analysts tend to note that should there be no phase 1 deal anytime soon, the next date to watch out for is December 15th when new tariffs are to be rolled out. It should be noted that Consumer Confidence dropped for a 4th consecutive month providing worries for the greenback and traders attention could be turned to the slew of data released from the US today, just before the US thanks-giving holiday period. EUR/USD continued to hover over the 1.1050 (S1) support line yesterday. We expect the pair to maintain its sideways motion, yet today’s financial releases could be providing some volatility for the pair. Should the pair come under the selling interest of the market, we could see it breaking the 1.1050 (S1) support line which on the 14th of the month contained the drop of the pair. Should (S1) be broken we could see the pair aiming for the 1.1000 (S2) support level. Should the pair’s long positions be favored by the market, we could see EUR/USD aiming if not breaking the 1.1105 (R1) resistance line, before advancing further.

Other economic highlights today and early tomorrow

Today, during the American session from the US we get durable goods orders growth rates for October, the second estimate of the US GDP growth rate for Q3, the US consumption rate, the Pending home sales change and the Fed’s favorite inflation measure, the Core PCE price index rate (the last three being for October)and EIA’s crude oil inventories figure. During tomorrow’s Asian session, we get from Japan the retail sales growth rate for October which is forecasted to have a heavy deceleration from September’s highs of +9.9% yoy. The effect could have been caused by the new, highly controversial, sales tax hike implemented by Abe’s government in October. Ten minutes later, we get New Zealand’s business confidence for November and Australia’s capital expenditure growth rate for Q3. As for speakers EU Commission President Von der Leyen, ECB’s Enria and Lane are scheduled to speak, yet we tend to focus on BoJ’s Governor Kuroda speech in the Asian session tomorrow. Also be advised that the Fed is to release the beige book in the American session.

Support: 1.1050 (S1), 1.1000 (S2), 1.0950 (S3)

Resistance: 1.1105 (R1), 1.1170 (R2), 1.1230 (R3)

Support: 1.0535 (S1), 1.0495 (S2), 1.0450 (S3)

Resistance: 1.0570 (R1), 1.0605 (R2), 1.0650 (R3)