The New Zealand dollar rose today as the country released its trade data for October. The numbers showed that exports increased from $4.36 billion to $5.03 billion. Imports rose from $5.68 billion to more than $6.05 billion. As a result, the trade deficit narrowed from $1.31 billion to $1.01 billion. These were impressive numbers coming at a time when the world is going through a trade war. These numbers came a day after the country released positive retail sales for October. 11 of the 15 retail sectors rose in October.

US stocks continued their winning streak as the market cheered retail earnings. These earnings are usually viewed as a positive thing for the economy because they project consumer strength. The Dow rose by 55 points while the S&P500 gained by 0.2%. These gains were led by Best Buy, which reported better-than-expected results and raised its outlook. The same was true for Dick’s Sporting Goods. In addition to these sales, the market cheered a report from China that said that both sides had made progress on trade talks. The question that remains is when the two sides will sign the first phase of the deal. Another question is whether there will be a second phase.

The US dollar was relatively unchanged in overnight trading as the market waited for an important stream of economic data. The market will receive the initial jobless claims data. These numbers will be released early as the Thanksgiving weekend is expected to start tomorrow. The market will receive the second reading of the third-quarter GDP data. Other important data that will be released will be durable goods orders, PCE data, pending home sales, personal income, and spending, and real personal consumption. In addition, the EIA will release the crude oil inventories data.

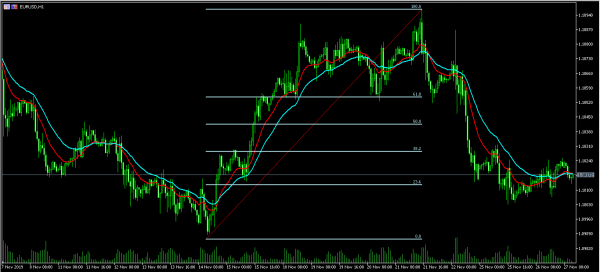

EUR/USD

The EUR/USD pair declined slightly as the market continued to wait for important data from the US and Europe. The pair is trading at 1.1017, which is slightly below yesterday’s high of 1.1025 and slightly above the week’s low of 1.1000. The price is slightly above the 23.6% Fibonacci Retracement level. The price is along the 14-day and 28-day moving averages. This consolidation is likely a sign that there could be a big breakout after important US data.

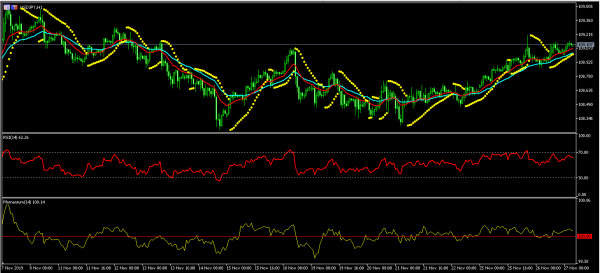

USD/JPY

The USD/JPY pair rose to a high of 108.15 ahead of important data from the United States. The pair has been on a strong upward trend, rising from a low of 108.27. The price is trading above the 14-day and 28-day moving averages. The RSI has been moving on an upward trend while the momentum indicator is trading above the 100 level. The dots of the Parabolic SAR are below the price, which is a positive sign.

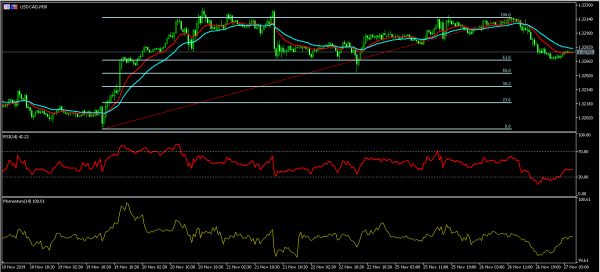

USD/CAD

The USD/CAD pair has been on a downward trend this week. The pair has moved from a high of 1.3316 to a low of 1.3266. The price is now trading at 1.3275, which is above the 61.8% Fibonacci Retracement level. The price is along the 14-day moving averages and below the 28-day moving averages. The RSI has moved from a low of 17.68 to a high of 41. The momentum indicator has also been soaring. The pair may resume the downward trend to test the 50% Fibonacci Retracement level of 1.3250.