First, a review of last week’s events:

EUR/USD. Recall that the previous forecast focused on the uncertainty that has been reigning in the markets recently. At that time, the preponderance of the bulls’ supporters over the bears was only 10%. 55% of experts voted for the growth of the European currency, against were 45%. As if responding to such a balance of forces, the pair grew slightly on Monday, November 11 and, reaching the level of 1.0900, moved into a sideways trend. It stayed there until Friday, when, due to weak European statistics (PMI) and the speech of the new Head of the ECB Christine Lagarde, it went down sharply. However, it could not break through the support of 1.1000 and ended the five-day period at 1.1020.

Ms. Lagarde added more fog and uncertainty to the markets, saying that Europe needed a new system of economic measures and that the European regulator would soon review its strategy. But what this new strategy will be is completely unclear, especially recalling that there is discord in the ECB Governing Council and there is no consensus on the resumption of quantitative easing (QE);

GBP/USD. The UK is preparing for early parliamentary elections, on which both the situation with Brexit and the further economic situation in the country depend. There is no clarity for now, as in the case of the Euro. Therefore, both bulls and bears are looking for reasons to push the pair in one or another direction, in the economic news.

If we sum up the results of the past week, the victory has remained for the bears. Taking advantage of the fact that the preliminary PMI business activity index in the services sector fell below the critical level of 50.0 and amounted to 48.6, they pushed the pair down to the level of 1.2822. The final chord of the week was made at the level of 1.2835;

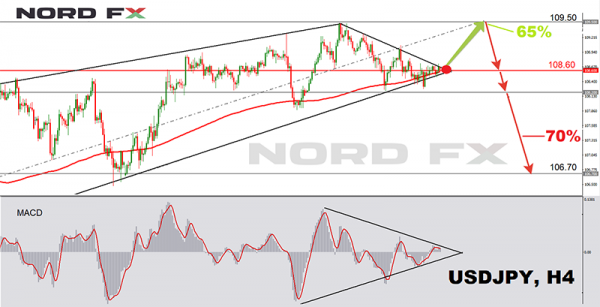

USD/JPY. As already noted, the yen has been falling for almost all autumn, and the pair has been moving up, relying on the MA200 on the four-hour timeframe. At least four attempts to break through this support have ended in failure. And how the fifth attempt will end, we wrote last week, depends largely on the prospects of signing a trade agreement between the US and China. However, despite a lot of optimistic statements, there are no specific results yet. American negotiators seem to be ready for the meeting but are waiting for assurances from the Chinese side that Beijing is ready to commit to the protection of intellectual property and technology, as well as the purchase of agricultural products from the United States. Whether China will do it, and in what form, is a question. And so the fifth attempt to break through the МА200 undertaken in the middle of last week, failed as well. Having fallen to the level of 108.27, the pair turned around and finished the week session slightly above the specified moving average, at the level of 108.63;

cryptocurrencies. The main “forecast”, which most often sounds recently, can be reduced to only two words: “caution” and “pessimism”. We hope that traders and investors followed our first advice, because the second one has once again justified itself completely: at the low on Friday November 22, Bitcoin lost almost 20%, falling from $8,500 to $6,820. The reason for such a bearish rally, according to many experts, were miners who began an active sale of their crypto assets. Some of them needed fiat to stay afloat and continue to work, and some, disappointed, just decided to leave the market.

An additional impetus to the sales was given by rumors from Chinese Shanghai about the visit of the police to the office of the Binance crypto exchange.

Top altcoins, such as Ripple (XRP/USD), Ethereum (ETH/USD) and Litecoin (LTC/USD), amicably followed the “big brother”, Bitcoin. As a result, the total capitalization of the crypto market decreased by 15.8%, from $239 billion to $201 billion.

As for the forecast for the coming week, summarizing the opinions of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

EUR/USD. The number of applications for unemployment benefits in the United States has risen again. The GDP growth in the fourth quarter is still not even up to 0.5%. All this makes investors think about the onset of a recession in the American economy. Next week we are waiting for the next batch of macroeconomic indicators from the United States, which will either confirm or refute the version about the possible next reduction of the Federal Reserve interest rate in January-February. Moreover, such a reduction may not be “traditional” 0.25%, but twice as much, 0.5%.

Of course, this largely depends on the final results of the fourth quarter and 2019 as a whole. But do not forget that 2020 is the year of the US Presidential election, and the state of the American economy depends on whether Trump will remain in the White House for a second term. For now, under his pressure, the Fed is implementing easing policies step by step and pumping the economy with dollars. A similar situation was in the early 2000s. Then, by lowering the rates, the Fed tried to raise production, and it resulted in a bubble of mortgage lending, which burst, leading to the crisis of 2007-2008.

At the moment, the vast majority of indicators are colored red. But in the situation of uncertainty described above, experts do not expect that the pair will still be able to break through the support of 1.1000. Graphical analysis on H4 and D1 also indicates that after one or two unsuccessful attempts to do this, the pair will turn around and go up: first to the resistance of 1.1090, and then even higher, up to the horizon of 1.1175.

Of course, the results of the next round of the US-Chinese trade talks, which Beijing wants to hold before November 28, Thanksgiving In the US, can greatly affect the quotes. 65% of analysts expect that a certain consensus will be reached on this issue by the end of the year, which will lead to the growth of the dollar and the decline of the EUR/USD pair to the zone 1.0800-1.0900;

GBP/USD. In anticipation of the parliamentary elections in the UK on December 12 and a Brexit respite, the pair has been moving in the side channel 1.2780-1.2980 for the fifth week. Trend indicators and D1 oscillators are painted in neutral gray. The forecasts of experts can be called “gray” too (50% to 50%). The hearing of the Inflation Report on Wednesday November 27 is unlikely to push the pair beyond this channel. The situation in the coming week depends much more on the US than on the UK. And the clear progress in the US-China trade talks may give the pair a strong bearish impulse, lowering it to the support of 1.2650;

USD/JPY. The Fed is pumping the markets with dollar liquidity. But the Bank of Japan has been doing the same for many years in an effort to increase inflation and revive production. At the same time, the interest rate set by the Japanese regulator for the yen is much lower than for the dollar. So the Japanese currency is of interest to investors only as a refuge from financial storms. However, according to the chart, there have been no particularly strong storms since the end of the summer, and therefore the yen is falling, and the curve of quotations is steadily creeping up.

Now there is a consolidation in the zone of 108.60 yen per dollar. But progress in signing a trade agreement between the US and China may push the pair further up – to the level of 109.50. It is this movement that most experts (65%) expect from it in the near future.

It should be noted that in the medium term, even more analysts (70%) are waiting for the pair to turn south and return to the 105.70-106.70 zone. And at most, these expectations are related to the deterioration of US economic indicators and further quantitative easing by the Fed;

cryptocurrencies. At the time of writing this forecast, the BTC/USD pair is approximately where it was a month ago, before the “space” takeoff on October 25. Recall that the benchmark cryptocurrency reached $10,500 then, adding 40% at its highest point, due to the news that Chinese President Xi Jinping had supported the blockchain development.

If you look at the chart, it is very clear that, since June 26, Bitcoin has been moving in a downward channel. And if this movement continues, we can expect first a sideways movement along the horizon of $7,300, and then another collapse, now down to $5,000.

The main hope of investors which may be able to support the bitcoin exchange rate is the 2020 halving. According to some of them, after halving in 2020, the rate of this cryptocurrency can soar by 4000%. They cite the sharp jumps in the value of the main digital asset, which occurred after the last two cuts in rewards for miners, as an argument. After the first cut, it rose by 3420%. After the second – by 4080%.

At the moment, the Crypto Fear & Greed Index of bitcoin has fallen into the lower red quarter and is equal to 23, which corresponds to “extreme fear”. According to the creators of the index, this indicator can mean that the market is in a strong panic, and it is probable that the growth will begin soon. After all, large speculators who bought coins, playing for a decrease to earn, must at some point start the game to increase. This, in fact, is the logic of the market.