U.S. Highlights

- Stocks were volatile this week amid signs that U.S.-China trade talks may be stalling. Cautious optimism briefly returned on Friday on news that the Chinese president was calling for the two sides to “strengthen communication”.

- The housing data released this week was uniformly upbeat. Both construction (+3.8% m/m) and resale activity (+1.9% m/m) picked up in October, suggesting that the housing market was responding nicely to lower mortgage rates.

- The FOMC minutes revealed that most participants judged that three rate cuts left monetary policy sufficiently accommodative to meet the Fed’s objectives, suggesting the Fed is putting back on its “data-dependence” hat.

Canadian Highlights

- Speeches by Bank of Canada officials painted a resilient picture of Canada’s economy and signaled a reluctance to ease policy barring a deterioration in economic data.

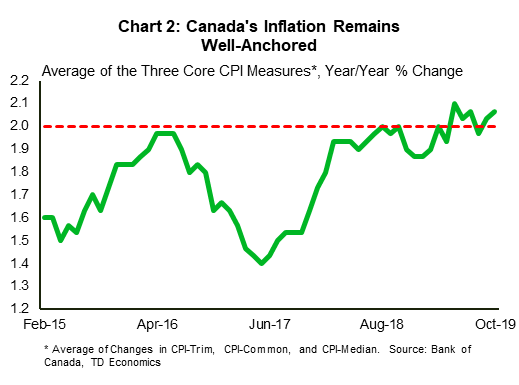

- The week was also heavy on data but light on major surprises. Consumer price inflation came in largely as expected, up 1.9% (y/y), with the core measures also still hovering near the 2% mark.

- Meanwhile, retail sales came in slightly better than expected (-0.1%), but manufacturing sales were weak, falling 0.7% in volume terms.

U.S. – Housing Market Remained A Bright Spot in October

Stocks were volatile this week amid signs that U.S.-China trade talks may be stalling. But, cautious optimism returned on Friday on news that the Chinese president was calling for the two sides to “strengthen communication”. The economic data calendar was sparse, with releases limited to housing data, which was upbeat. Both construction (+3.8% m/m) and resale activity (+1.9% m/m) picked up in October, suggesting that the housing market was responding nicely to lower mortgage rates.

On the demand side, home sales continued to push higher, rising in three of the past four months as lower mortgages rates boosted affordability. In October, the National Association of Realtor’s affordability metric posted its strongest reading since the end of 2017 – a welcome development for prospective home buyers. That being said, without an equivalent response on the supply side, the latest improvement in affordability might prove fleeting. The already-low inventory of houses on the market has been declining year-over-year for four straight months. This has stymied additional activity and pushed home prices higher, with median home prices up 6.2% from a year ago – a significant acceleration from the roughly 3.5% pace seen at the start of the year.

To be fair, construction activity has also shown improvement, with housing starts up 8.5% from a year-ago. U.S. home builder sentiment remains elevated, and single-family building permits have risen for six consecutive months. This suggests that construction will likely continue making headway in the months ahead (Chart 1). As such, residential investment is expected to grow at a solid 5% pace for the second consecutive quarter in Q4, after contracting in 2018 and the first half of 2019.

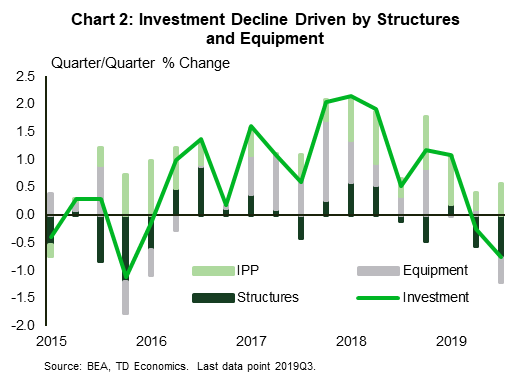

While the housing market has recently emerged as a bright spot, business investment has been a drag on growth. Since last year businesses have found themselves in a deep fog of economic uncertainty brought about by volatile policy making and the U.S.-China trade war, making them reluctant to commit to new investment projects. As we discuss in our recent report, equipment spending – the largest component of business investment – has borne the brunt of the uncertainty impact (Chart 2), with the rise in uncertainty reducing equipment investment by an estimated 4% from 2018Q1 to 2019Q3. The resolution of the trade war could help boost investment. However, a sustained improvement will only be possible once firms are convinced that policy-making will not be as volatile as it has been over the last few years.

The minutes of the FOMC meeting last month revealed that members were also not expecting a quick turnaround in business investment, stating that “trade uncertainty and sluggish global growth would continue to dampen investment spending and exports.” Furthermore, officials have noted that while risks remained “tilted to the downside”, monetary policy was sufficiently accommodative to support outlook of “moderate growth, a strong labor market” and inflation near 2% target following three rate cuts this year. Thus, with regard to future monetary policy, the Fed is putting back on its “data-dependence” hat, and only a material change in the economic outlook will move it off the sidelines.

Canada – Bank of Canada Still on the Sidelines

This was a packed week for Canada, with high-profile economic data releases and closely-watched speeches from Bank of Canada officials filling the calendar. The S&P/TSX Composite Index fell a modest 0.4% (as of noon Friday) this week as risk sentiment moved sideways on mixed news about a U.S.-China trade deal. The Canadian dollar also fluctuated on remarks by Bank of Canada officials, but still ended the week down modestly versus its U.S. counterpart. The week also saw the beginning of a labour disruption at a major rail carrier. Early TD Economics analysis suggests that should the dispute stretch into December, it could have a notable impact on fourth quarter GDP.

Taking center stage this week were speeches by the Bank of Canada’s top two officials. Echoing earlier communications, both signaled the central bank’s reluctance to cut rates barring a notable deterioration in data. Indeed, Senior Deputy Governor Carolyn Wilkins acknowledged increasing global headwinds, but highlighted Canada’s resilience, its progress on managing financial stability concerns, and the central bank’s preference to continue taming these vulnerabilities. On that note, the Bank worries that a significant and further easing of monetary policy may exacerbate household debt levels and reignite housing market vulnerabilities. In the same vein, Governor Poloz delivered a fireside chat which highlighted the same message. The most significant takeaway from his speech was his reference to monetary policy conditions being “about right.”

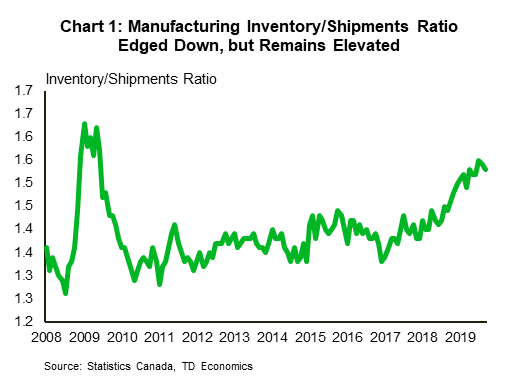

On the data front, three key economic releases were brushed off as they reiterated long-standing narratives in place. The story remains unchanged: Canadian consumers are holding on, inflation remains well-anchored, but business activity is moderating and facing global headwinds. Kicking off the release schedule was a disappointing manufacturing sales print. Real shipments were down 0.7% in September. While some of the weakness was transitory, the broad-based sectoral and regional declines were disappointing. The deterioration in forward looking indicators and the still-elevated inventory/shipments ratio also suggest that further weakness in production may be in the pipeline (Chart 1). In contrast, September’s retail sales report came in slightly better than expected, edging down by a modest 0.1%. The sector’s longer-term performance remains lackluster (volumes have been flat since 2018). However, strong labour markets and a recovery in housing activity have supported an improvement in momentum, with quarterly volumes growth rising since the start of the year.

Meanwhile, headline consumer price inflation for October came in as expected at 1.9% (y/y) with the core measures continuing to hold near the 2% mark (Chart 2). Stable inflation has been key in keeping the Bank on the sidelines, as indicated in Governor Poloz’s comments this week.

All told, this week’s developments imply that the Bank of Canada will be in a heightened data-dependency mode in the quarters ahead. The Bank has communicated its preference to remain on the sidelines, but also signaled its willingness to open its toolbox if economic data worsens, albeit with a higher bar to action than in the past. Close attention will be paid to global headwinds, especially any spillovers into the consumer spending or housing sectors.

U.S: Upcoming Key Economic Releases

Personal Income and Spending – October*

Release Date: November 27, 2019

Previous: Spending: 0.2% m/m; Income: 0.3%

TD Forecast: Spending: 0.2% m/m; Income: 0.4%

Consensus: Spending: 0.3% m/m; Income: 0.3%

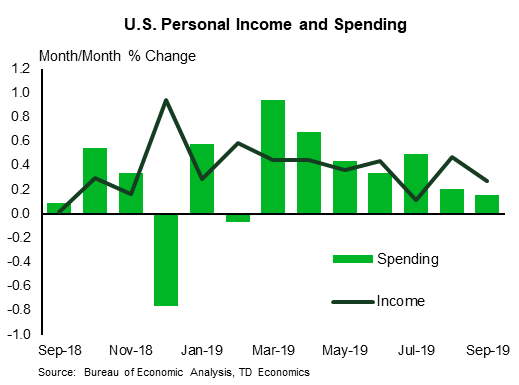

We anticipate growth in personal spending to remain steady for a third consecutive month at 0.2% m/m in October. Given our forecast of headline PCE inflation at 0.3% m/m (0.2% for core), real spending growth was likely flat for the month, lowering its pace to 2.2% at the start of Q4 from 2.9% in Q3. In the details, we expect a solid 0.4% m/m increase in services spending to be the main driver of the October gain, however a notable drop in durables spending likely dented the overall boost. Moreover, we forecast income to rise a strong 0.4% m/m, following an also firm 0.3% increase in September.

Canada: Upcoming Key Economic Releases

Real GDP – Q3 & September

Release Date: November 29, 2019

Previous: 0.1%

TD Forecast: 0.1%

Consensus: NA

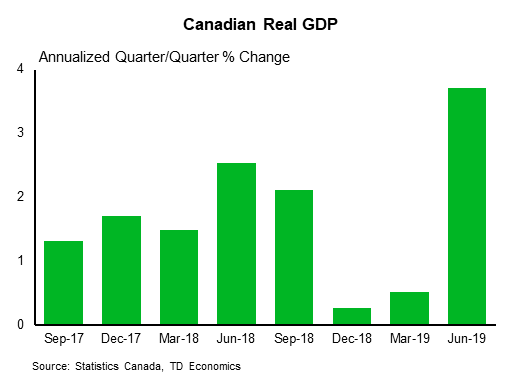

TD expects that the pace of economic growth fell markedly in the third quarter, tracking a 0.9% (q/q, annualized) expansion. A large part of the slowing is down to net trade – exports are likely to have stood still in the third quarter (+0.0%), while imports came back somewhat following an earlier contraction (+2.7%). Only middling growth is anticipated for non-residential business investment (+1.7%) as uncertainty continues to take its toll. Consumer spending is forecast to accelerate somewhat, but to only a modest (+1.7%) pace of growth. Residential investment (+9.6%) is expected to be the bright spot, helped by strength in both resale and homebuilding activity.

Industry-level GDP is projected to rise by 0.1% in September, as stronger service sector activity is offset by a drag from manufacturing. Manufacturing shipments fell by 0.7% m/m in real terms, capping off a disappointing Q3 for the industrial sector and weighing on more positive developments in the goods-producing sector. Oil and gas should provide a tailwind even with lingering shutdowns weighing on offshore activity, and construction activity should make a modest positive contribution on stronger residential building activity. Meanwhile, services will benefit from the continued recovery in existing home sales along with an anticipated rebound in wholesale trade. A 0.1% print will provide a muted handoff to Q4, where we expect another quarter of sub-trend growth.