Wall Street rose slightly yesterday as Donald Trump delivered a speech to economists and business leaders at the Economic Club of New York. In the speech, Trump expressed his optimism that China and the US would ultimately do a large deal. A report by Wall Street Journal highlighted that tariffs had become the main stumbling block for the deal. The issue centres on whether the US had agreed to remove all tariffs in phase one of talks or tariffs that were set to take effect on December 15. Last week, China said that the two countries had agreed in principle to lower tariffs.

The New Zealand dollar rose sharply after the Reserve Bank of New Zealand delivered its interest rates decision. The bank surprised the market by leaving interest rates unchanged at 1.0% instead of lowering them to a predicted 0.75%. In the accompanying monetary statement, the bank said that economic developments since the August meeting did not justify a cut and that it expected the economy to remain subdued in the remaining part of the year. The committee also discussed the benefits of slashing rates or leaving them unchanged. They agreed to leave rates unchanged and perhaps intervene if the outlook changed.

It will be a busy day for the market as traders receive information from several countries. In Europe, the market will receive CPI data from countries like Germany, Sweden and the UK. In Germany, the CPI is expected to remain unchanged at 1.0% while in Sweden, it is expected to increase slightly from 1.5% to 1.6%. In the UK, the CPI is expected to decline slightly from 1.7% to 1.6%. Core CPI is expected to remain unchanged at 1.7%. In the United States, the headline CPI is expected to have remained unchanged at 1.7%. The core CPI is expected to have remained unchanged at 2.4%. The market will also listen to Jerome Powell as he testifies in congress.

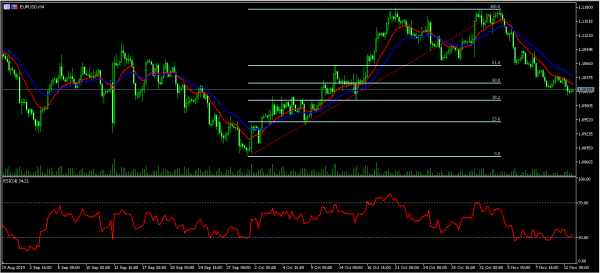

EUR/USD

The EUR/USD pair was little changed as the market waited for CPI data from the US and Europe. The market is also waiting for Powell’s testimony in Congress. The pair is trading at 1.1015, which is between the 50% and 38.2% Fibonacci Retracement level. The RSI has moved to slightly above the oversold level of 30. The pair will likely remain in a holding pattern ahead of the inflation data and Powell speech. Key points to watch will be the 23.6% Fibonacci level of 1.0950 and the 61.8% Fibonacci level of 1.1050.

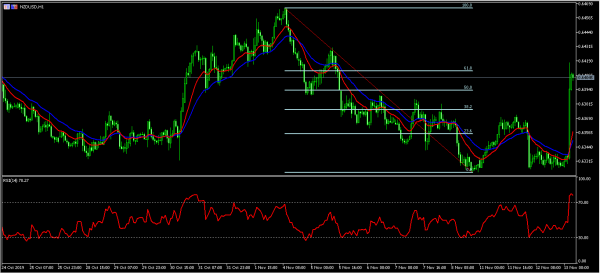

NZD/USD

The NZD/USD pair rose sharply after the RBNZ left rates unchanged. The pair rose to a high of 0.6417, which was higher than the previous low of 0.6323. On the hourly chart, the current price is slightly below the 61.8% Fibonacci Retracement level. The RSI shot to a high of 80.30 while the pair moved above all the short and long-term moving averages. The pair will likely move slightly lower as the market waits for a speech by Adrian Orr, the RBNZ Governor.

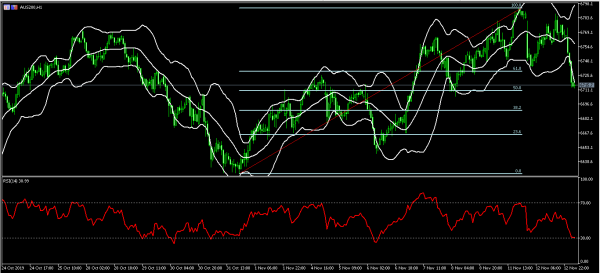

AUS200

Australian stocks declined by 50 basis points as the market worried about trade. The biggest losers were companies like Beach Energy and Orocobre, which declined by more than 4%. The index declined from a high of $6788 to a low of $6712. On the hourly chart below, the price is slightly above the 50% Fibonacci Retracement level. The price is also along the lower line of the Bollinger Bands while the RSI has moved to the oversold low of 30. The price may continue to decline to test the important support of $6700.