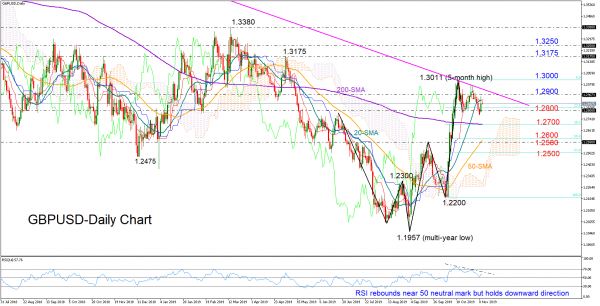

GBPUSD started the week in the green after falling slightly for three consecutive days. The rebound happened around the 1.2800 support level and the 23.6% Fibonacci of the upleg from 1.2200 to 1.3011, but the bullish action was not strong enough to pierce the 1.2900 mark.

Although the RSI managed to bounce back into the bullish area, the indicator continues to hold a downward direction since mid-October, while in Ichimoku indicators, the red Tenka-sen is flattening above the blue Kijun-sen line, all signaling a positive but weak picture for the short-term.

Traders would like to see a rally above the descending trendline that connects the peak on October 21 and the 2018 high of 1.4375 in order to place buying orders. However, the pair first needs to pierce the 1.2900 mark before challenging the trendline. In case the resistance line falls apart, the spotlight will shift to the 5-month high of 1.3011, a break of which may lead the price up to the 1.3175-1.3250 area.

Alternatively, a decisive step below the 1.2800 level could find a barrier in the crossroads of the 38.2% Fibonacci of 1.2700 and the 200-day simple moving average (SMA). If the obstacle proves easy to get through, the 50% Fibonacci of 1.2600 and the previous high of 1.2580 would determine whether the uptrend off 1.1957 is sustainable, while a sell-off below 1.2500 would turn the positive medium-term picture into a neutral one.

Summarizing, GBPUSD is likely to trade mildly positive in the short-term, with the descending trendline expected to challenge any rallies. In the medium-term window, the pair continues to hold an upward direction as long as it trades above 1.2500.