Gold has retraced from its November high of $1,516 but it is still up more than 18% year-to-date. The important element to note here is that the price is still trading well above the $1,500 mark—a critical level which really gives a lot of hope to bulls.

Gold Price Neglects Equity Markets Strength

Despite the fact that the S&P500 has recorded new record highs (on October 28, the S&P500 made a high of 3637), the gold price has been moving higher. Usually, a risk-on trade—meaning when the equity markets start to move higher—is associated with a risk-off trade; the gold price usually moves lower. But, this textbook trade has failed to materialize. This shows that the bulls do have some force behind them.

Economic Docket Isn’t Good

It is important to keep in mind that the overall US economic docket does paint a pessimistic picture. The recent US ISM manufacturing number released on Friday (actual 48.3 against the forecast of 49) shows that the manufacturing sector is feeling the pain caused by the trade war. However, the US GDP and US labor data are improving from a relative perspective –the US non-farm employment came in at 128K while the US GDP q/q stood at 1.9%. If manufacturing continues to suffer it would take down the labor market and the only solution to this problem is the cease-fire between the US and China.

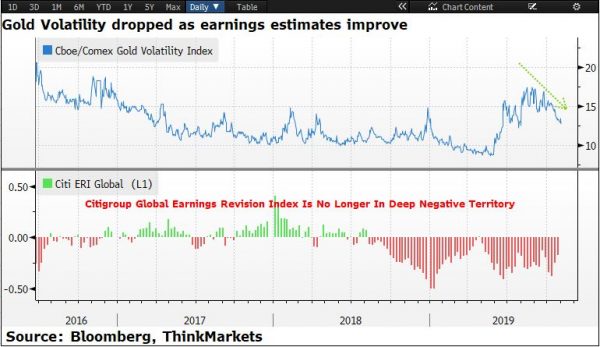

Gold Volatility And Earning Estimates

Another lens that we can use to measure the momentum of the gold price is by looking at the gold volatility. The GVXX index, it shows the volatility for gold, has dropped substantially. This has happened when the CGERGLOB, Citi ERI global index—it measures the global equity upgrade and downgrade revision by analysts—has improved considerably. The current reading of this index is -0.17. Once again, investors are still betting on the gold price to move higher despite the fact when the underlying fundamental of the equity markets have improved. It shows investors do not feel comfortable in keeping too much risk on their books and they like to have a hedge in place—a phenenoma which is common when the US equity markets are near record highs.

Price Action Says It All

From a technical price action perspective, we have formed a bullish price pattern—ascending triangle—on a daily time frame. The projection of this triangle could easily push the price well above $1,650.

To conclude, the momentum of the gold price is strong. This is despite the fact that traders do know that the trade deal could be happening any day. However, investors do not feel fully comfortable to place their eggs in one basket-the equity markets and this is keeping the gold price higher.