We’ve had an absolute cracker of an overnight session with plenty of central bank risk impacting markets and driving volatility and liquidity higher right across the board. Not to mention the Asia session ahead is also fraught with event risk. A longer ASIA MORNING than usual but well worth it.

Asia looking data heavy

…NZ Business Confidence

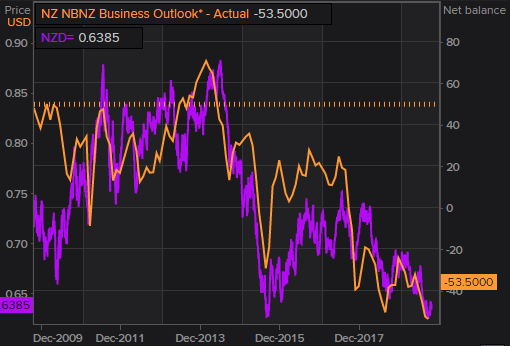

There’s plenty to focus on in today’s first half of Asia trading with a couple of events hitting the wires in quick succession. First up is Oct. NZ Business Confidence due at 11.00am AEDT. Business confidence has slumped over the last year with September’s print of -53.5 the lowest it’s been in a decade. Another weak print here could further strengthen bets that RBNZ cut in their Nov. 13 meeting. Markets are currently pricing in a 57% chance that the RBNZ make a 25bps cut next month. NZDUSD has closely tracked the cadence of the measure and we expect it to partially fade this morning’s strong bid if a weak print arises.

…Aussie Building Approvals

Not long after, we catch Sep. Aussie Building Approvals at 11.30am AEST and a few other household credit data points. Building Approvals are forecast for a 0.5% increase on the prior month. We suspect any reaction in AUDUSD to the print will be subdued given an RBA cut in Nov. was all but scrubbed following yesterday’s in line CPI print, which saw strengthened bets for an RBA hold. The combination of local and global rate dynamics keeps our AUDUSD double bottom formation in play with an upside target of 0.7079.

…China Mfg PMI

Last up, China Manufacturing PMI is due at 12.00pm AEDT. Expectations are set for a print 49.8 unchanged from the prior month. This is a number we think markets will be paying close attention to. Risk sentiment could be further boosted if we see an increase which supports the view that China has a soft landing and that things are looking up globally in manufacturing. While China’s GDP came in at 6% a few weeks back, September activity data in IP, FAI and RS was decent. Therefore, there could be some upside risk to this number.

…BoJ meeting

Markets also wait on the BoJ’s rate decision released sometime today. We expect the BoJ to keep its policy rates unchanged in line with market expectations. For a deeper dive, see SPECIAL REPORT: Ahead of BoJ October.

FOMC rate decision

With all but a tiny percentage of the futures market pricing in a 25bps rate cut, the Fed duly delivered on expectations in its Oct. rate decision. The Fed Funds target range, previously at 1.75-2.00%, was shifted lower by 25bps to 1.50-1.75%. Asides from the rate cut, markets were firmly focussed on the Fed’s intention for future easing going into the decision. In the end, a cut was delivered with a slightly hawkish lean.

We suggest slightly hawkish due to some language changes where the Fed looks to now “assess the appropriate path of the target range” as oppose to “act as appropriate to sustain the expansion”. Less acting and more assessing makes the Fed more data-dependent, and consistent with less easing bias seen in market pricing of the curve out till 2020.

Having said that though, Powell stopped short of saying the Fed would hike anytime soon. He acknowledged that while uncertainties around US-China trade and Brexit have subsided, there would need to be a “material move up” in core inflation before hiking begins. Given there’s still a clouded outlook on US-China trade policy as we note here, Powell will likely want to maintain monetary flexibility should the situation make a turn for the worse.

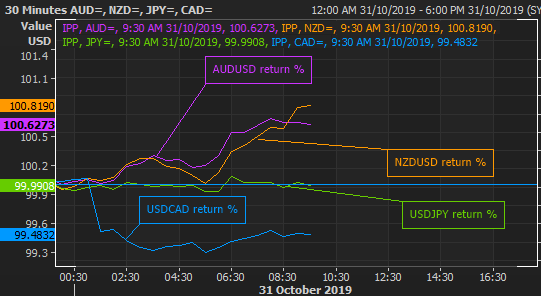

Asia markets were initially risk-off on the decision before tides turned to risk-on in the press conference. AUDUSD and NZDUSD are bid +50pips. USDJPY tested August highs of 109.3 but is back down to 108.9 levels. Notably, there wasn’t a strong bid in ASX futures, however, we still expect the cash benchmark to open marginally higher.

APEC summit cancelled

Due to ongoing protests, Chile decided to cancel the APEC summit set to be held in Santiago. Trump and Xi were due to meet after the summit to finalise phase one of US-China trade talks. Equities were slightly softer on the news awaiting clarification. Headlines have since emerged that the “time frame remains unchanged despite the cancellation” with some suggesting that Macau may be offered as an alternative venue. Though deadline risks are now off the table for the widely anticipated signing, there’s concerns around further delays. This falls in line with our thesis that downside risks to US-China trade talks are underappreciated and under-priced.

Other notable mentions

BoC made no changes to its ON Target Rate as we suggested in our SPECIAL REPORT: Ahead of BoC October. Though, did come out with a slightly dovish lean. The central bank cited trade risks and geopolitical uncertainties will “increasingly test” the domestic economy. The cutting bias and removal of explicit forward guidance saw USDCAD break through 1.3145 resistance before testing 1.32 later in the night as long CAD positioning pulled back.

Earlier in the night, we also saw US Advance GDP print better than expectations 1.9% vs 1.6% consensus.