Canadian Dollar is sold off sharply today after more dovish than expected BoC statement. USD/CAD’s rebound suggested that it has defended 1.3052 fibonacci level, thus retains medium term bullishness. EUR/CAD’s rebound now turns favor, slightly, to the case of medium term bottoming at 1.4415. It’s a bit early to call for near term bearish reversal in CAD/JPY, but the case could build up ahead.

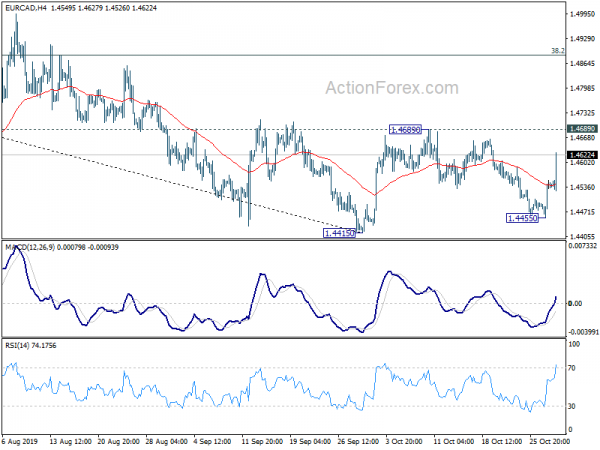

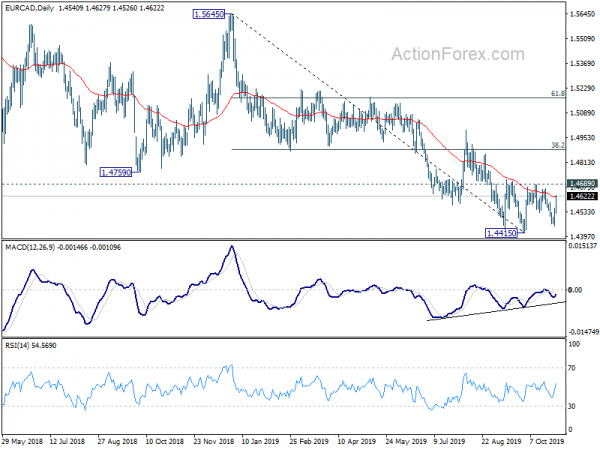

EUR/CAD’s strong rise suggests that corrective pull back from 1.4689 has completed at 1.4455, ahead of 1.4415 low. Focus is now back on 1.4689 near term resistance. Note that bullish convergence condition in seen in daily MACD. Decisive break of 1.4689 should also have 55 day EMA sustainably taken out. Such development would suggests medium term bottoming at 1.4415. It’s early to tell if price actions from 1.4415 is developing into an up trend or a corrective rise. But in any case, break of 1.4689 should pave the way to 38.2% retracement of 1.5645 to 1.4415 at 1.4885.

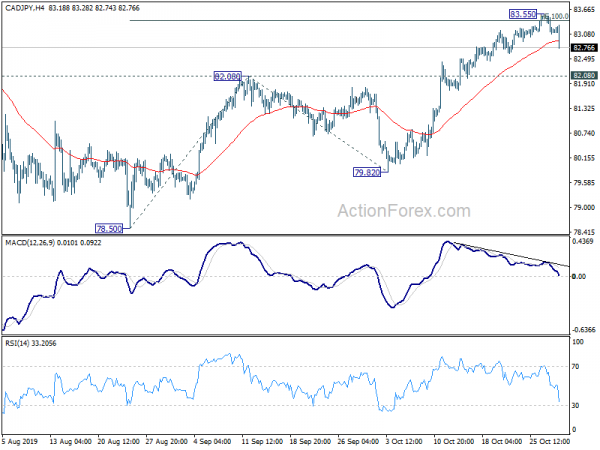

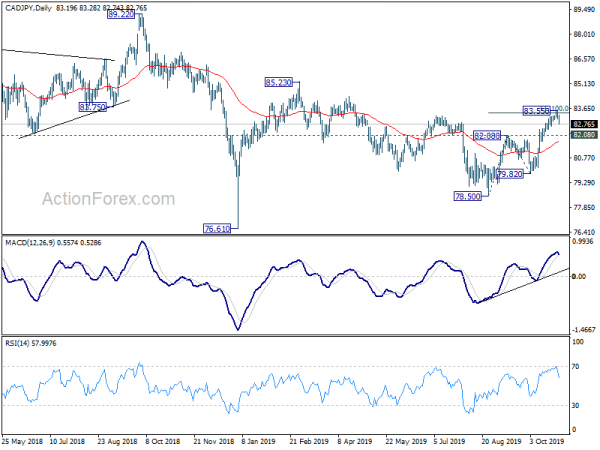

CAD/JPY’s sharp decline suggests that short term top is formed at 83.55 on bearish divergence condition in 4 hour MACD. That also came after hitting 100% projection of 78.50 to 82.08 from 79.82 at 84.40. At this point, price actions from 83.55 are seen as a corrective pattern first and further rise is in favor. Break of 83.55 will target 85.23 key resistance next. However, break of 82.08 will solidify that case that corrective rise from 78.50 has completed with three waves up to 83.55. In that case, deeper fall would be seen to 79.82 support and below, to extend the consolidation pattern from 85.23.