Lowe’s speech to frame RBA thinking over the next week

The highlight of today’s quiet Tuesday calendar lies in RBA Gov. Lowe’s speech in Canberra at 5.45pm AEDT. We expect the speech to offer some insights into the policy implications of Aussie quarterly CPI and building approvals out later this week, and importantly, also frame the tone and expectations for the RBA’s November 5 meeting next month. As it stands, markets are implying a 77% probability that the RBA hold in Nov with the odds of a December rate cut looking more even at 50-50.

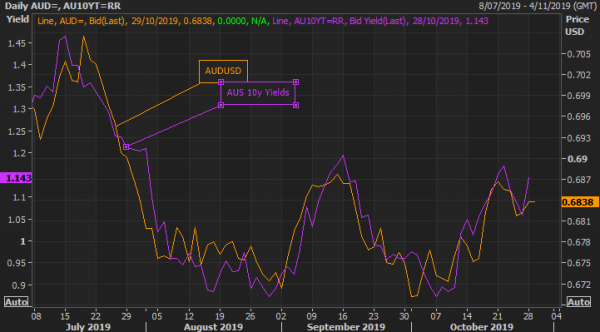

We think there’d have to be a compelling miss in data out this week to change the RBA’s likely hold which strengthened off the back of the recent Aussie jobs report. However, we also look to the Fed’s all-important rate decision on Thursday. Should the Fed cut as widely expected, it may open the door to some dovish re-pricing of rate expectations in Nov. and Dec. given the RBA will want to stymie any substantial AUDUSD strengthening.

Gold and USDJPY sensitive to trade talks

Risk assets have made another push higher overnight fuelled by positive US-China trade rhetoric and the lack of bad news. Trump announced that the US were “looking probably ahead of schedule to sign a very big portion of the China deal”, referring to phase 1. While downside risks and trade policy uncertainty still remain in our minds, we recognise that markets will take these comments at face value.

USDJPY, a strong indicator of risk-on/risk-off sentiment, momentarily tested 109 but has since edged lower to 108.97. A meaningful break of August highs of 109.31 makes 109.92 the next resistance level. Gold similarly tends to sell-off in this environment. It climbed to US$1,518/oz but has since corrected to US$1,490. We see support around Oct. lows of US$1,460/oz which largely coincides with Gold’s 100d MA.

Brexit delayed until Jan 31, 2020

An update to our Brexit coverage. The EU have reluctantly accepted a delay to Brexit until Jan. 31, 2020 with Donald Tusk, European Council President, noting that “this is unwanted” and is “damaging to our democracy”. Markets did little on the news given the outcome was largely priced in. We now look to a general election to break the deadlock, however, also flag that Johnson’s attempt to call an election overnight has been voted down.