While yen’s free fall continues in early US session, Dollar stabilizes mildly. Economic data from US are supportive. Initial jobless claims rose 2k to 244k in the week ended June 24. That’s the 121 straight week of sub-300k reading. Four week moving average dropped 2.75k to 242.25k. Continuing claims rose 6k to 1.948m in the week ended June 17. It stayed below 2m mark for 11 straight week. Q1 GDP growth was revised up to 1.4% annualized, from 1.2% annualized. GDP price index was revised down to 1.9%, from 2.2%. Overall, there is no sign in bottoming in the greenback yet and it’s still vulnerable to further selloff against Euro, Sterling, Franc, Canadian and Australian. For the week so far, Sterling is the strongest, followed by Euro and then Canadian.

BoE Haldane: Need to look seriously at raising rate

In UK, BoE chief economist Andy Haldane said today that the central bank needs to "look serious at the possibility of raising interest rates to keep the lid of those cost of living increases". He noted that "for now we are happy with where the rates are", but "we need to be vigilant for what happens next". BoE’s monthly report on money and credit showed that unsecured consumer credit rose by 10.3% yoy in May, five times as fast as earnings growth. The GBP 1.7b growth in May alone was faster than the average of GBP 1.5b average in the past six months. That is seen by economists as another reason for BoE to raise interest rates, to curb consumer lending. Released from UK, mortgage approvals was unchanged at 65k in May.

ECB expected to announce tapering in September or October

ECB’s current EUR 60b per month asset purchase program will end by the end of the year. Markets are now expecting the central bank to announce tapering in September, by latest October. Some expect the tapering to last for a year till December 2018. Meanwhile, opinions on the timing of ECB’s first rate hike various. According to a Reuters survey, 90% of currency traders expected a hike in the first quarter of 2018. But some expect that to happen in early 2019.

Sentiment indicators in Eurozone generally improved. Business climate rose to 1.15, up from 0.9, beat expectation of 0.93. Economic confidence rose to 111.1, up from 109.2, beat expectation of 109.5. Industrial confidence rose to 4.5, up from 2.8, beat expectation of 2.8. Services confidence rose to 13.4, up from 13.0, beat expectation of 13.4. Consumer confidence was finalized at -1.3. Released from Germany, CPI rose 0.2% mom, 1.6% yoy in June, up from prior -0.2% mom and 1.5% yoy, beat expectation of 0.0% mom, 1.4% yoy. Gfk consumer confidence rose to 10.6, above consensus of 10.4.

BoJ Harada: Too early to do anything

BoJ board member Yutaka Harada said today that a weaker yen will stimulate the economy and accelerate inflation. Meanwhile, if the 2% inflation target comes into sight, BoJ might reduce or even top ETF purchases. However, for the moment, it’s still too early to do anything as inflation is far off the target. On the other hand, Harada believes the current stimulus is "already sufficiently bold" and he’s confident that inflation will gradually approach 2%. Released from Japan, retail sales rose 2.0% yoy in May,

USD/JPY Mid-Day Outlook

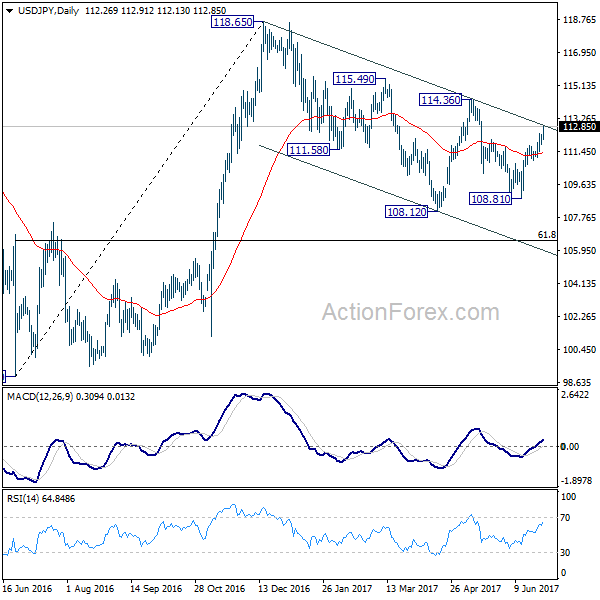

Daily Pivots: (S1) 111.96; (P) 112.18; (R1) 112.55; More…

USD/JPY rises to as high as 112.91 in early US session and touching near term channel resistance. Intraday bias stays on the upside. Sustained break of the channel will argue that whole pull back from 118.65 has completed at 108.12 already. In such case, further rise should be seen to 114.36 resistance for confirmation. On the downside, below 111.82 minor support will turn bias neutral first. If that happens, we’ll assess the near term outlook alter.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. It’s uncertain whether it’s completed yet. But in case of another fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77 to bring rebound. Overall, rise from 75.56 is still expected to resume later after the correction from 125.85 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y May | 2.00% | 2.80% | 3.20% | |

| 01:00 | NZD | ANZ Business Confidence Jun | 24.8 | 14.9 | ||

| 06:00 | EUR | German GfK Consumer Confidence Jul | 10.6 | 10.4 | 10.4 | |

| 08:30 | GBP | Mortgage Approvals May | 65K | 64K | 65K | |

| 09:00 | EUR | Eurozone Business Climate Indicator Jun | 1.15 | 0.93 | 0.9 | |

| 09:00 | EUR | Eurozone Economic Confidence Jun | 111.1 | 109.5 | 109.2 | |

| 09:00 | EUR | Eurozone Industrial Confidence Jun | 4.5 | 2.8 | 2.8 | |

| 09:00 | EUR | Eurozone Services Confidence Jun | 13.4 | 12.8 | 13 | |

| 09:00 | EUR | Eurozone Consumer Confidence Jun F | -1.3 | -1.3 | -1.3 | |

| 12:00 | EUR | German CPI M/M Jun P | 0.20% | 0.00% | -0.20% | |

| 12:00 | EUR | German CPI Y/Y Jun P | 1.60% | 1.40% | 1.50% | |

| 12:30 | USD | GDP (Annualized) Q1 T | 1.40% | 1.20% | 1.20% | |

| 12:30 | USD | GDP Price Index Q1 T | 1.90% | 2.20% | 2.20% | |

| 12:30 | USD | Initial Jobless Claims (JUN 24) | 244K | 240K | 241K | 242K |

| 14:30 | USD | Natural Gas Storage | 61B |