US commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) dropped -1.7m barrels in the week ending October 18, versus expectation of 2.5m barrels increase. At 433.m barrels, crude oil inventories are at the five year average for this time of year.

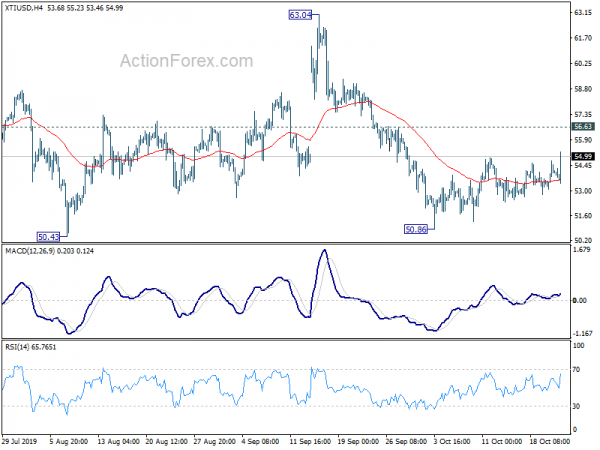

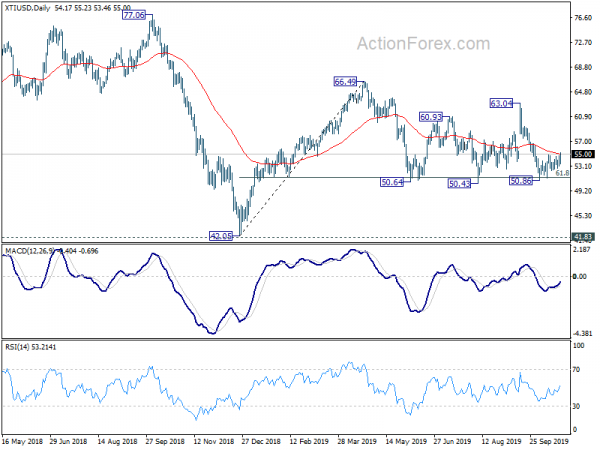

WTI crude oil’s recovery from 50.86 extends higher after the realize. The support from 4 hour 55 EMA is a bullish sign. But structure of the price actions from 50.86 remains corrective look. Hence, it’s still seen as in a corrective face for now. That is, another fall could be seen to test 50 psychological level before bottoming. Meanwhile, break of 54.71 will indicate near term reversal and target 63.04 resistance.