Sterling declined after a disappointing week for Boris Johnson. On Saturday, the British parliament voted to demand an extension on Brexit. In response, Boris Johnson sent a letter to the European Union requesting for another extension. In another letter, Johnson requested the EU not to agree to an extension. In a statement, Johnson said that he would introduce the deal made with the European Union to parliament. His foreign secretary said that a cross-party coalition of 320 MPs had agreed to back the deal. An analysis by Financial Times found that there could be a majority of five members. It will be a success for Boris Johnson if he is able to see a deal pass in the divided parliament.

The Japanese yen declined slightly after the ministry of finance released provisional numbers of September trade numbers. The numbers showed that exports declined by 5.2% from the previous year while imports declined by -1.5%. This was the tenth month of straight declines. Exports came in at Y6.368M while imports came in at Y6.41M. Exports to China declined by 6.7% while imports declined by 1.5%. Exports to the US declined by 7.9%. In the past few months, exports data from Japan has shown some weakness because of the impacts of the trade war. Further, while the unemployment rate has remained low, inflation has continued being below BOJ’s target of 2%.

Later today, earnings will be the main focus in the market. Earnings from some of the biggest American companies are expected this week. Today, companies to watch will be Halliburton, PetMed Express, HomeStreet, and Del Taco. These results will come a week after the earnings started with the release of key data from American banks like Morgan Stanley, JP Morgan, Goldman Sachs, and Citi. Meanwhile, the market will continue to focus on Boeing, which has received significant negative press during the weekend.

EUR/USD

The EUR/USD pair declined slightly in reaction to the Brexit news. As of writing, the pair is trading at 1.1155, which is lower than Friday’s high of 1.1172. On the four-minute chart, the price is slightly above the 14-day and 28-day moving average while the RSI has remained above the overbought level of 70. The price is above the 61.8% Fibonacci Retracement level while the momentum indicator remains above the 100 level. Its price may continue moving higher later today as a continuation of the current trend.

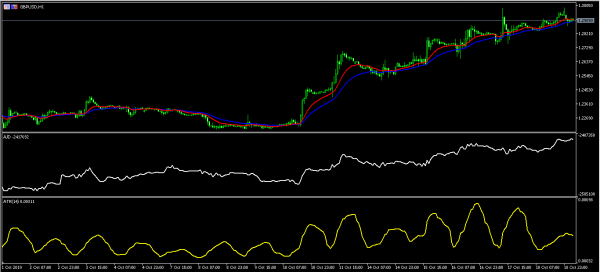

GBP/USD

GBP/USD pair declined today after the weekend Brexit drama. On the hourly chart, the price is trading at 1.2908, which is below Friday’s high of 1.2990. On the hourly chart, the price is trading along the 14-day and 28-day moving averages. The accumulation/distribution indicator has continued to jump while the average true range has flattened slightly. Today, the pair may be a bit volatile as traders focus on new developments on Brexit.

USD/CHF

USD/CHF pair moved slightly higher today and is trading at 0.9853. On the 30-minute chart, the price is slightly above Friday’s low of 0.9840. Still, the price remains much lower than last week’s high of 0.9995. This price is along the 14-day and 28-day moving averages. Today, the pair may continue moving higher as it attempts to test the 23.6% Fibonacci Retracement level of 0.9875.