Sterling and Canadian Dollar jumped sharply overnight as comments from BoE Governor Mark Carney and BoC Governor Poloz hinted at rate hikes ahead. Canadian Dollar is additional supported by the rebound in oil price, which sees WTI breaching 45 handle. Euro suffered some jitters on report that markets misjudged ECB President Mario Draghi’s hawkish comments. But traders quickly turned to the bigger picture that ECB is, nonetheless, in a transition phase into stimulus removal. Euro remains the strongest major currency for the week, followed by Sterling and Canadian Dollar. On the other hand, the Japanese Yen is trading as the weakest as BoJ is expected to maintain stimulus. Dollar follows as markets are in doubt whether Fed will hike again in September.

BoE Carney: To debate rate hike in the coming months

BoE Governor Mark Carney said that "some removal of monetary stimulus is likely to become necessary if the trade-off facing the MPC continues to lessen and the policy decision accordingly becomes more conventional". And, as "spare capacity erodes", the "tolerance for above-target inflation falls". Carney said that the MPC will debate some of the issues "in the coming months". That’s sharp turn from his own comments that "now it’s not the time yet" for rate hike last week. And Carney is now more in-line with chief economist Andy Haldane that who noted that it would be "prudent" to begin removing accommodations "into the second half of the year".

Markets pricing in July hike after BoC Poloz comments

BoC Governor Stephen Poloz said that the rate cuts back in 2015 "have done their job" to counter the impact of falling oil price on the economy. And, the central bank is "approaching a new interest rate decision". He noted that for the decision "we need to be at least considering that whole situation now that the excess capacity is being used up steadily." He pointed out that regarding recovery momentum "the US obviously was way out in front. Canada some distance, perhaps as much as two years behind, given the oil shock. And then a little bit behind of course Europe." Markets took Poloz’s comments as a signal that a rate hike in July 12 meeting is something that policymakers will consider. And, financial markets are pricing in over 50% chance for that.

Misjudged or not, ECB still on course to stimulus removal

Euro’s rally started early this week on ECB President Mario Draghi’s comment that "the threat of deflation is gone and reflationary forces are at play". There were then report yesterday saying that markets have misjudged. And, Draghi merely wanted to strike a balance between recognizing Eurozone’s strength while maintaining that policy accommodation is still needed. But after all, the messages were still the same as what we pointed out before. Firstly, Draghi isn’t concerned with the slowdown in inflation and judged that as "on the whole temporary". He is also optimistic on the outlook that "all the signs now point to a strengthening and broadening recovery in the euro area". So ECB is still on course to scale back monetary stimulus ahead. And September is still the time to debate and decide what to do after the current EUR 60b asset purchase program ends in December.

Markets doubtful on September Fed hike

On the other hand, news for US haven’t been positive this week. In particular, markets are getting more impatient and doubtful on US President Donald Trump’s ability to push through his economic agenda. Senate’s delay of the healthcare vote was another sign of loss of political influence. IMF lowered US growth forecast after removing the "assumed fiscal stimulus" is another sign that analysts are giving up. Fed fund futures are pricing in less than 20% chance of a rate hike in September. It will now very much depend on the Q2 data to come out in July.

On the data front

Japan retail sales rose 2.0% yoy in May. New Zealand ANZ business confidence rose to 24.8 in June. Germany will release Gfk consumer confidence and CPI in European session. Eurozone confidence indicators will also be featured. UK will release mortgage approvals. From US, Q1 GDP final will be released with jobless claims.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 126.88; (P) 127.37; (R1) 128.27; More…

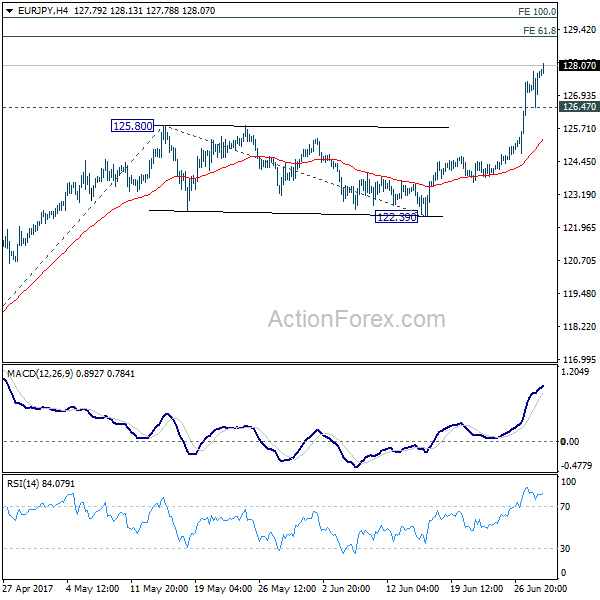

EUR/JPY’s rally resumed after brief retreat and hits as high as 128.13 so far. Intraday bias is back on the upside. Current rise from 114.84 is expected to target 61.8% projection of 114.84 to 125.80 from 122.39 at 129.16 first next. That’s also close to medium term projection level at 129.89. On the downside, below 126.47 minor support will turn bias neutral and bring consolidations before staging another rally.

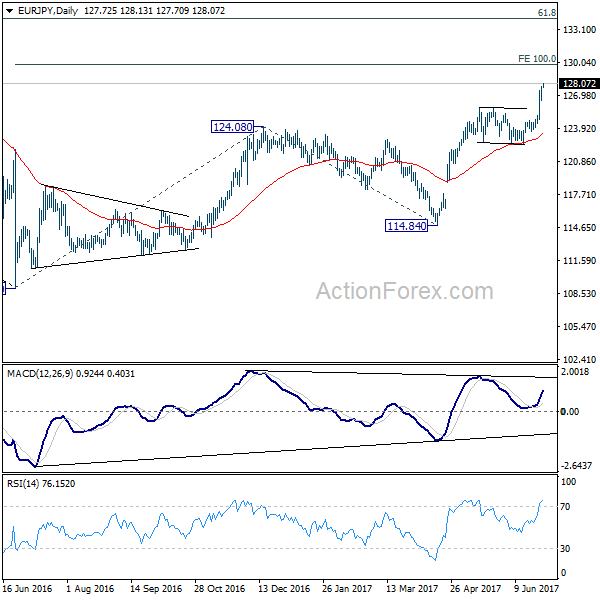

In the bigger picture, the break of 126.09 support turned resistance should have confirmed completion of down trend form 149.76 (2014 high), at 109.03 (2016 low). Current rise from 109.03 should target 100% projection of 109.03 to 124.08 from 114.84 at 129.89 first. Break there will pave the way to 61.8% retracement of 149.76 to 109.03 at 134.20 and above. Medium term outlook will now remain bullish as long as 122.39 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y May | 2.00% | 2.80% | 3.20% | |

| 1:00 | NZD | ANZ Business Confidence Jun | 24.8 | 14.9 | ||

| 6:00 | EUR | German GfK Consumer Confidence Jul | 10.4 | 10.4 | ||

| 8:30 | GBP | Mortgage Approvals May | 64K | 65K | ||

| 9:00 | EUR | Eurozone Business Climate Indicator Jun | 0.93 | 0.9 | ||

| 9:00 | EUR | Eurozone Economic Confidence Jun | 109.5 | 109.2 | ||

| 9:00 | EUR | Eurozone Industrial Confidence Jun | 2.8 | 2.8 | ||

| 9:00 | EUR | Eurozone Services Confidence Jun | 12.8 | 13 | ||

| 9:00 | EUR | Eurozone Consumer Confidence Jun F | -1.3 | -1.3 | ||

| 12:00 | EUR | German CPI M/M Jun P | 0.00% | -0.20% | ||

| 12:00 | EUR | German CPI Y/Y Jun P | 1.40% | 1.50% | ||

| 12:30 | USD | GDP (Annualized) Q1 T | 1.20% | 1.20% | ||

| 12:30 | USD | GDP Price Index Q1 T | 2.20% | 2.20% | ||

| 12:30 | USD | Initial Jobless Claims (JUN 24) | 240K | 241K | ||

| 14:30 | USD | Natural Gas Storage | 61B |