US stocks declined yesterday, just two days after the US and China announced a truce on trade. The declines happened as traders continued to worry about the impact of the deal that was announced. The Dow lost 30 points while the broader S&P500 declined by 4 points. The declines also happened ahead of the earnings season, which will start today as the big US banks like Wells Fargo, JP Morgan, Citi, and Goldman Sachs are expected to release their earnings. Other big companies that are expected to release today are Charles Schwab, Blackrock, and Johnson & Johnson.

The sterling rose in overnight trading as traders continued to wait for more information on Brexit. Yesterday, sources from Brussels told the media that there was still a long way to go for the deal to be completed. This is because of the major differences regarding North Ireland. The UK has insisted that the entire country will not be part of the EU customs union while the EU wants some sort of an insurance policy. Later today, the UK will release the employment numbers for the month of August. The unemployment rate is expected to remain unchanged at 3.8% while wage growth ex-bonus is expected to decline to 3.7% from the previous 3.8%.

The euro was relatively unchanged in the Asian session. This is after Donald Trump announced a new set of tariffs on Turkey for its violence in Northern Syria. Turkey is an important trade partner for the European Union. Later today, the market will receive the current conditions and economic sentiment data from the EU. From Germany, the ZEW current conditions are expected to decline to -26.0 from the previous -19.9. The economic sentiment is expected to have declined from -22.5 to -27.0.

EUR/USD

The EUR/USD pair was relatively unchanged in the Asian session. As of writing, the pair is trading at 1.1025, which is still lower than yesterday’s high of 1.1062. On the hourly chart, the price has formed a symmetric triangle pattern that is nearing its peak. This is an implication that a breakout could happen in either direction. This is confirmed by the moving averages, which are along the price of the pair. If the pair breaks out higher, there is a possibility that it will retest the previous high of 1.1062. If it moves lower, it will likely retest the previous support of 1.1000.

GBP/USD

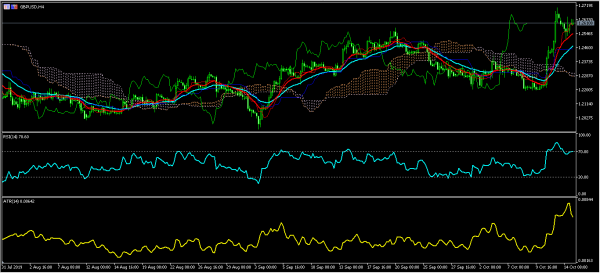

The GBP/USD pair rose slightly during the Asian session. As of writing, the pair is trading at 1.2608, which is above the previous low of 1.2515 and lower than Friday’s high of 1.2705. On the four-hour chart, this price is above the 25-day and 50-day moving averages. The RSI has moved significantly upwards to the overbought level. Also, the price remains above the Ichimoku cloud. The average true range, which is a good indicator of volatility has increased sharply. This implies that the pair will likely move in either direction.

BTC/USD

The price of Bitcoin was relatively unchanged as more companies decided to leave the Libra association. Yesterday, Priceline became the latest company to abandon the project. Others that have left are Mastercard, Visa and Stripe. The BTC/USD pair is trading at 8317.82. This is slightly higher than yesterday’s low of 8129. This price is between the 50% and 61.8% Fibonacci Retracement level. The price is along the short and medium-term moving averages. At this point, the pair could move in either direction.