Trade talk optimism drives sizable risk rally

NY positive momentum driven by Brexit and trade talk headlines sets Asia up for a strong open. I’ve detailed the chronological order of yesterday’s US-China soundbites as they hit the wires but since then, more comments have come from both camps that build on the net optimistic tone. Notably, Vice Premier Liu He mentioned to Xinhua news that China comes with “great sincerity and is willing to cooperate with the US on trade balance, market access and investors’ protection”, while Trump announced at a press conference that he thinks “everything is going really well [after day 1 talks]”. The net impact has been improved risk sentiment that’s led to some solid risk-on price action – USDCNH down, USDJPY up, commodity bloc FX up, equities up and bonds yields up – in NY and G10 FX liquidity 250% greater than average daily volumes over the last 30 days. Markets are clearly pricing in “a partial deal” between the two powerhouses.

But major grievances still at large

The caveat, though, as I touched on earlier in the week in a US/China Playbook piece is that there’s asymmetric risk in the outcomes. Some of these headlines, which markets have accepted at face value, have not only come from questionable sources but also eschew the core grievances that have been audible in the US camp from day one. Conviction still remains on edge and has the propensity to change very quickly should signs appear that anything less than a partial deal be the end result. If US and China fail to get agreement on meaningful structural changes then it could lead to further escalation down the road. Hence, the downside risks are in my view still greater than the upside move we get in any partial-deal scenario.

ASX pivot points

Overnight rallies in equities has ASX 200 Futures nearing an intra-week pivot point. I’d expect some active resistance at 6,580-85 if it pushes higher at the open in line with where markets were selling it back on Tuesday. Seeing as it’s also popped above the 200D-SMA, we should find initial support to the downside around those levels at 6,560-65. The 50D-SMA at 6,530-35 is likely to also provide support to the downside. Given broader developments the ASX could be on a new path.

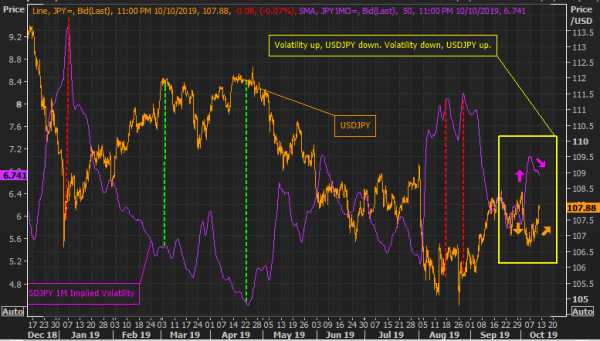

USDJPY and 1-month implied volatility negative relationship holds

The rallies in USDJPY have consistently moved with falls in USDJPY 1-month implied volatility, and vice versa. This makes sense given JPY’s status as a safe-haven asset. When uncertainty rises; markets take out more insurance in the options market; option costs therefore rise and mean higher implied volatility; and subsequently, markets flood to JPY as a safe-haven asset leading USDJPY lower.