The US dollar index was unchanged after the Federal Reserve released minutes of the previous meeting. The minutes showed that officials are worried about a potential downside to the economy in 2020. The likelihood of a recession has increased because of the risks associated with trade war and geopolitics. Officials also reported increased household spending while business fixed investment and exports had declined. Later today, the market will receive the CPI data from the US.

Sterling rose slightly in overnight trading. Yesterday, hopes of a negotiated UK exit from the EU faded after ongoing talks ended. In a statement, Jean-Claude Juncker said that Brussels will not take the blame for a no-deal Brexit. He also said that he still had hopes that such a situation was not in the EU’s interests. Chief Negotiator, Michel Barnier, said that there was still hopes for a deal to be made. Later today, the market will receive the first reading of the third quarter GDP data. The economy is expected to have grown by just 0.9%. This will be lower than the previous growth of 1.3%. In August, manufacturing production is expected to have contracted by -0.7% while the industrial production is expected to have contracted by -0.9%.

The Japanese yen declined slightly in the American session after the country released the PPI and machinery orders numbers. In September, the country’s bank lending rose by 2.0%, which was lower than the previous 2.1%. Core machinery orders declined by an annualised rate of -14.5%. This was lower than July’s gain of 0.3%. On a MoM basis, machinery orders declined by -2.4%, which was slightly better than the expected decline of -2.5%. Meanwhile, producer prices declined by -1.1% after declining by -0.9% in August.

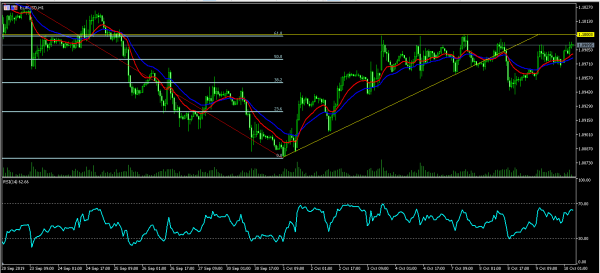

EUR/USD

The EUR/USD pair rose slightly in the Asian session and is trading at 1.0988 as of this writing. This price is below the resistance of the ascending triangle pattern that has been forming. On the hourly chart, the pair is between the 50% and 61.8% Fibonacci Retracement level. The price is above the 14-day and 28-day moving averages while the RSI has moved slightly higher from the previous low of 30 to the current 62. The pair might attempt to reach the resistance level of 1.1000.

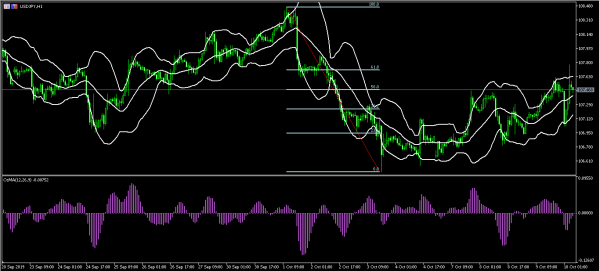

USD/JPY

The USD/JPY pair declined sharply and then pared those losses in the Asian session. This was after Japan released the PPI and machinery orders numbers. The pair declined to a low of 107.00 and then rose to a high of 107.76. On the hourly chart, the current price of 107.46 is along the 50% Fibonacci Retracement level. The price is between the middle and upper line of the Bollinger Bands. The moving average of the oscillator indicator is crossing to a positive level. The pair will possibly continue moving higher to retest the 61.8% Fibonacci level of 107.76.

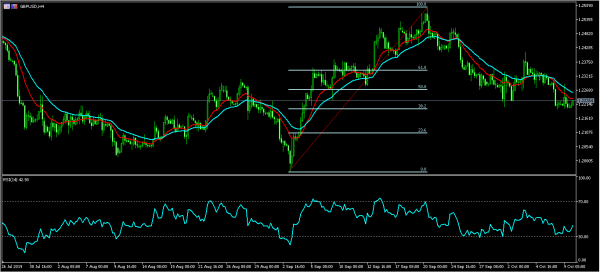

GBP/USD

After the sharp decline yesterday, the GBP/USD pair rose slightly and is trading at 1.2227. On the four-hour chart, the price is between the 38.2% and 50% Fibonacci Retracement level. The price is below the 14-day and 28-day moving averages while the RSI has increased slightly to 43. With the pair being at a key support, there is a scenario that it could decline to test the 23.6% Fibonacci Retracement level of 1.2100. It could also move higher to the 50% Fibonacci level of 1.2270.