Key Highlights

- Gold price recovered from $1,460 and settled above $1,485 against the US Dollar.

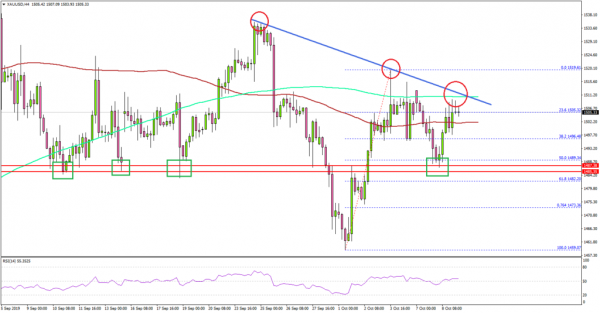

- There is a key bearish trend line forming with resistance near $1,510 on the 4-hours chart of XAU/USD.

- The US PPI declined 0.3% in Sep 2019 (MoM), whereas the forecast was +0.1%.

- Today’s FOMC Meeting Minutes could impact gold price in the short term.

Gold Price Technical Analysis

After trading to a new monthly low at $1,459, gold price started an upside correction against the US Dollar. The price recovered above the $1,480 and $1,485 resistance levels to move into a positive zone.

The 4-hours chart of XAU/USD indicates that the price even surged above the $1,500 resistance area and the 100 simple moving average (4-hours, red). A high was formed near $1,519 and recently the price corrected lower.

It declined below $1,500, but the $1,485 support area acted as a strong buy zone. Besides, the 50% Fib retracement level of the upward move from the $1,459 low to $1,519 high also provided a solid support.

On the upside, there is a strong resistance forming near the $1,510 and $1,515 levels. Moreover, there is a key bearish trend line forming with resistance near $1,510 on the same chart.

If there is a successful close above the trend line and $1,515, the price is likely to accelerate higher towards the $1,525 and $1,530 levels. Conversely, the price could break the $1,485 support area and move back into a bearish zone.

Fundamentally, the US Producer Price Index for Sep 2019 was released by the Bureau of Labor statistics, Department of Labor. The market was looking for a 0.1% rise in the index compared with the previous month.

The actual result was disappointing, as there was a 0.3% decline in the US PPI. Looking at the yearly change, there was a 1.4% rise in the PPI, less than the market forecast of 1.8%.

The report added:

The index for final demand less foods, energy, and trade services was unchanged in September after rising 0.4 percent in August. For the 12 months ended in September, prices for final demand less foods, energy, and trade services advanced 1.7 percent.

Looking at EUR/USD, the pair failed to break the 1.1020 resistance and declined recently. More importantly, GBP/USD declined heavily and broke the key 1.2250 and 1.2220 support levels.

Economic Releases to Watch Today

- US Wholesale Inventories for August 2019 – Forecast +0.4%, versus +0.4% previous.

- FOMC Meeting Minutes.