All eyes are set on the US NFP data. Given the weakness in the economic numbers so far, traders have started to price in the possibility of another interest rate cut by the Fed. As we said in our previous report that if the US ISM manufacturing and US ISM non-manufacturing number are dismal, market participants are going to look at the US NFP number through the Fed’s lense. What I mean is that investors are going to expect a reaction from the Fed.

We believe there are three major scenarios that we should be looking at

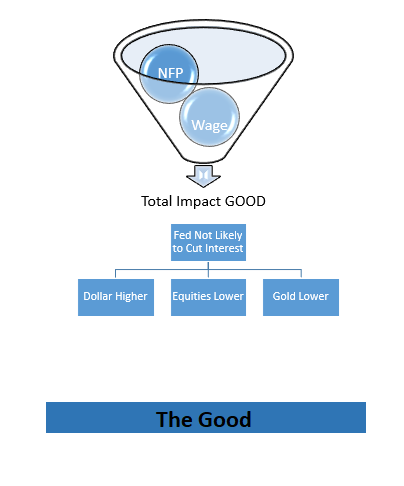

- The Good

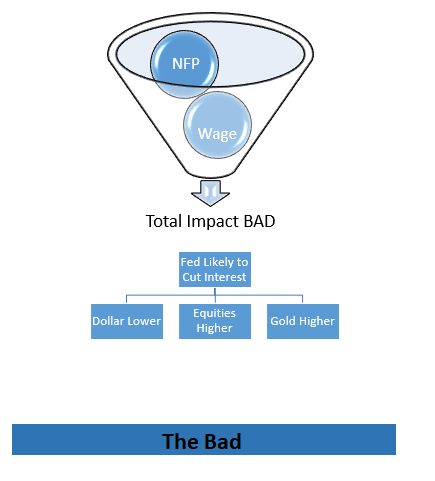

- The Bad

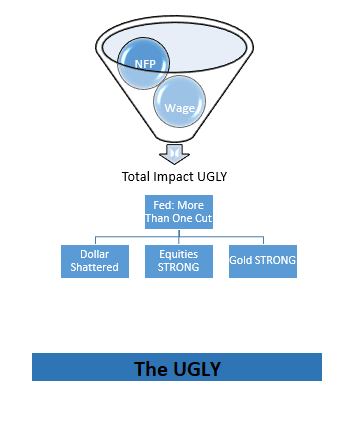

- The Ugly

The Good

We already know that the tone set by the economic data released this week is negative, so the US NFP number needs to be extra strong to change the overall impact to GOOD. This means that we need to see serious improvement in hourly earnings number, and in the headline number-the US NFP. If we get these numbers strong than the Fed Chairman, Jerome Powell is likely to play down the threats of recession. A disappointment from the Fed means that the dollar is likely to move higher, the major pairs like the euro-dollar and the sterling-dollar would move lower and the gold price could lose its shine.

The Bad

However, if the combination of the hourly earnings and the headline number produce mixed results, the overall effect is likely to be bad. This would mean that the Fed would have to say something on the interest rate, and the only rhetoric the market wants to hear from them is another rate cut. This would push the dollar lower, equities and gold price higher. Although, there is always a chance that we may not see much strength in the gold price because of a risk-on rally

The Ugly

Now, the ugly part, this means that both numbers, hourly wage and the NFP, are reflective of earlier economic data which we received this week. The overall impact would be ugly, and markets are going to expect more than one interest rate cut from the Fed for this year. This is likely to trigger a serious rally for the equity markets, the dollar would see a massive drop and gold would soar.