New Zealand ANZ Business Confidence dropped to -53.5 in September, down from -52.3. That’s also the worst reading since April 2008. Agriculture scored weakest confidence at -75.6 while manufacturing was best at -46.2. Activity outlook also dropped to -1.8, down from -0.5. Activity outlook was worst in construction at -7.1, best at services at -0.6.

ANZ noted that RBNZ will be “disappointed that its unexpectedly large 50bp cut in the Official Cash Rate last month does not appear to have had much impact on business’ sentiment or investment and employment intentions.” And, “prolonged lack of confidence is starting to feed its way through the economy and is threatening the tight labour market.” Also, “this gradual but prolonged economic slowdown is at risk of ceasing to be about the data and starting to become about the people.

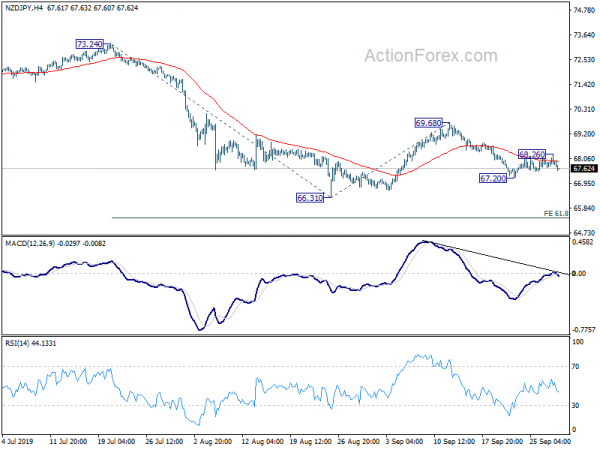

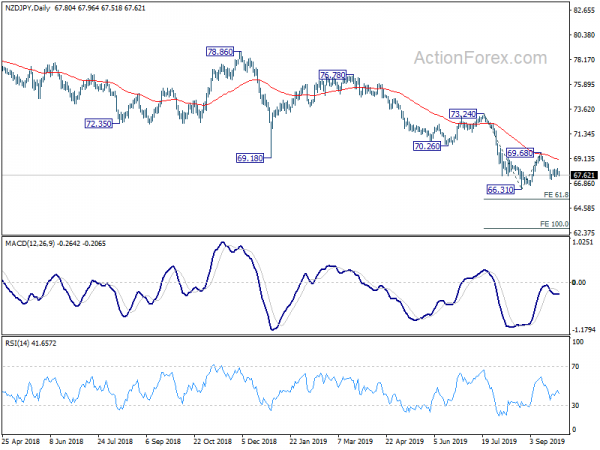

Today’s decline in NZD/JPY the release suggests the corrective recovery from 67.20 has completed at 68.26, after failing to sustain above 4 hour 55 EMA. Focus is immediately back on 67.20 and break will target a test on 66.31 low. Overall, NZD/JPY is clearly staying in near term down trend, held well by falling 55 day EMA. Next target is 61.8% projection of 73.24 to 66.31 from 69.68 at 65.39, and then 100% projection at 62.75.