Key Highlights

- The US Dollar started a downward move after it failed to break 0.9980 against the Swiss Franc.

- USD/CHF traded below a crucial bullish trend line at 0.9915 on the 4-hours chart.

- The ZEW Economic Expectations Index for Switzerland improved from -37.5 to -15.4 in Sep 2019.

- The US Gross Domestic Product is likely to grow 2.0% in Q2 2019.

USD/CHF Technical Analysis

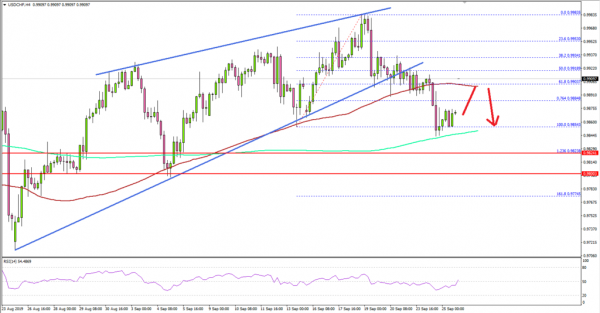

Earlier this month, the US Dollar extended its rise above the 0.9900 resistance against the Swiss Franc. The USD/CHF pair climbed towards 1.00, but it struggled to surpass the 0.9980 resistance and recently started a fresh downward move.

Looking at the 4-hours chart, the pair topped near 0.9983 and declined below the 0.9950 support area. Moreover, there was a break below the 50% Fib retracement level of the upward move from the 0.9854 low to 0.9983 high.

More importantly, the pair traded below a crucial bullish trend line at 0.9915 on the same chart. It opened the doors for more losses below the 0.9900 support and the 100 simple moving average (red, 4-hours).

The pair even tested the last swing low at 0.9854 and it remains at a risk of more downsides. The next key support is near the 0.9820 level since it coincides with the 1.236 Fib extension level of the upward move from the 0.9854 low to 0.9983 high.

Any further losses could lead the pair towards the key 0.9800 support area in the near term. Conversely, if there is a fresh increase, the pair may perhaps face hurdles near 0.9900 and the 100 SMA.

Fundamentally, the ZEW Economic Expectations Index for Switzerland (Sep 2019) was released by the Centre for European Economic Research. The market was looking for a minor improvement in the index from -37.5 to -32.0.

The actual result was better than the forecast as the ZEW Economic Expectations Index climbed to -15.4 in Sep 2019, but it is still in the negative zone.

Overall, USD/CHF could extend its decline towards 0.9800 before it starts a fresh upward move. Looking at EUR/USD, the pair is consolidating below the 1.1080 resistance area. On the other hand, GBP/USD seems to be struggling to hold an important support near 1.2350-1.2380.

Upcoming Economic Releases

- US Initial Jobless Claims – Forecast 212K, versus 208K previous.

- US Gross Domestic Product Q2 2019 – Forecast 2.0% versus previous 2.0%.

- US Pending Home Sales for August 2019 (YoY) – Forecast -1.9%, versus -0.3% previous.