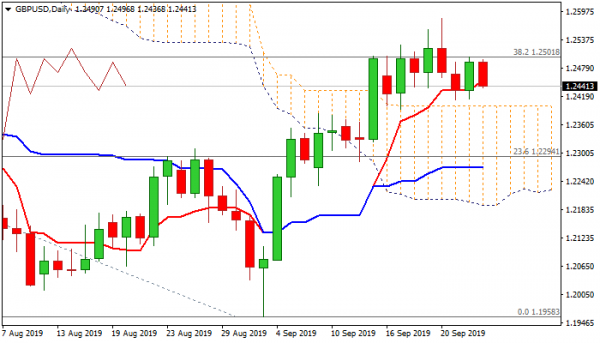

Cable eases below rising 10DMA (1.2458) in early European trading on Wednesday, failing to benefit from Tuesday’s bullish outside day, as another failure at 1.2501 pivot on Tuesday (Fibo 38.2% of 1.3381/1.1958) keeps the downside vulnerable. Failure to capitalize on Tuesday’s rule of UK Supreme Court that suspension of parliament was unlawful, suggests that traders continue to fear from various negative Brexit scenarios and following consequences. Near-term action is in sideways mode and market participants show strong indecision (last week ended in long-legged Doji) as various options remain on the table. Mixed technical studies add to current picture, as bullish momentum on daily chart is fading and stochastic continues to head south, while Ichimoku studies remain in bullish setup and thick daily cloud strongly underpins near-term action (cloud top lies at 1.2399). Break out of recent 1.2400/1.2500 range would generate initial direction signal, with penetration into cloud to expose supports at 1.2347/43 (20DMA / Fibo 38.2% of 1.1958/1.2582 upleg) while firm break of 1.2501 pivot would expose last week’s highs at 1.2560/82.

Res: 1.2502, 1.2526, 1.2560, 1.2582

Sup: 1.2413, 1.2399, 1.2343, 1.2294