Key Highlights

- The British Pound started a downside correction from 1.2580 against the US Dollar.

- GBP/USD might find bids near 1.2380 and a bullish trend line on the 4-hours chart.

- The US Manufacturing PMI in Sep 2019 (Prelim) increased from 50.3 to 51.0.

- The US Consumer Confidence (CB) could decline from 135.1 to 134.1 in Sep 2019.

GBP/USD Technical Analysis

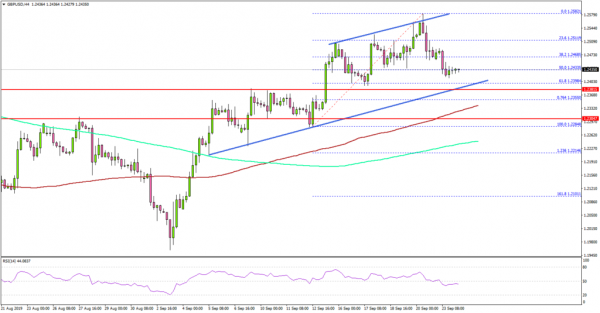

This past week, the British Pound climbed further higher above 1.2500 against the US Dollar. The GBP/USD pair traded as high as 1.2582 and it recently started a downside correction.

Looking at the 4-hours chart, the pair declined below the 1.2500 support level to start the current downward move. It declined below the 50% Fib retracement level of the upward move from the 1.2284 low to 1.2582 high.

However, there are many key supports on the downside near the 1.2400 and 1.2380 levels. Moreover, there is a key bullish trend line forming with support near 1.2380 on the same chart.

Below the trend line, the next key support is near the 1.2340 level and 100 simple moving average (red, 4-hours). If there is a bearish close below 1.2340 and the 100 SMA, the pair could start a fresh decline towards the 1.2200 support area.

On the upside, an immediate resistance is near the 1.2500 level. If there is an upside break above 1.2500, the GBP/USD pair could rise further towards 1.2580 and 1.2600.

Fundamentally, the US Manufacturing Purchasing Managers Index (PMI) (Prelim) for Sep 2019 was released by the Markit Economics. The market was looking for no change from 50.3.

The actual result was positive, as the US Manufacturing PMI increased from 50.3 to 51.0. Looking at the US Services Business Activity Index, there was a rise from 50.7 to 50.9.

The report added:

Private sector output increased in September, with the rate of expansion slightly faster than the three-and-a-half year low seen during August. The latest survey revealed modest rises in both service sector activity and manufacturing production.

Overall, GBP/USD is approaching a couple of important supports near 1.2380. On the other hand, EUR/USD and AUD/USD are trading in a bearish zone.

Upcoming Economic Releases

- German IFO Business Climate Index for Sep 2019 – Forecast 94.5, versus 94.3 previous.

- US Consumer Confidence (CB) Sep 2019 – Forecast 134.1, versus 135.1 previous.