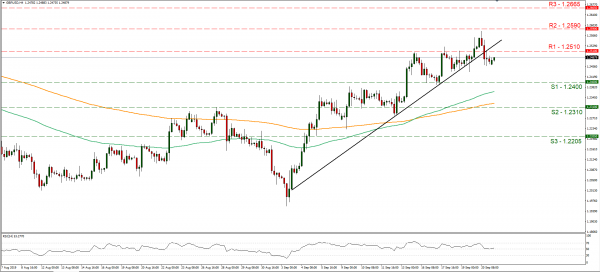

The pound weakened against the USD after a two-month high, as the Irish foreign minister stated that London and the EU were not yet close to a Brexit deal. Brexit optimism was further lowered as the Times reported that UK PM Johnson had told colleagues that he did not expect to reach full “Legally operable” deal, including the Irish border, by the meeting of the EU Council. Meanwhile it should be noted that EU carmakers have issued a dire warning about the prospects of the industry in case of a hard Brexit, increasing pressure on the EU political leadership. We expect that further developments are on their way as UK PM Johnson and Irish PM Varadkar are to meet in New York this week, and a similar meeting is also to take place with German Chancellor Merkel, raising the stakes for Brexit. Should there be positive headlines about a possible deal we could see the pound strengthen. Cable dropped on Friday breaking the 1.2510 (R1) support line, now turned to resistance. As the pair broke the upward trendline incepted since the 3rd of September, we switch our bullish outlook in favour of a sideways motion. Please note that volatility could be just around the corner, should there be new headlines about Brexit. Should the pair find fresh buying orders along its path, we could see it breaking the 1.2510 (R1) and aim for the 1.2590 (R2). Should cable come under the selling interest of the market, we could see it breaking the 1.2400 (S1) support line and aim for the 1.2310 (S2) support level.

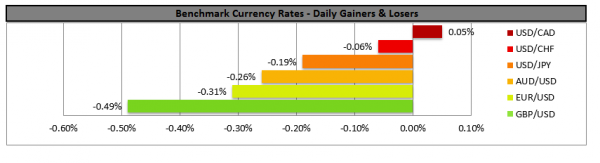

USD strengthens on trade talks

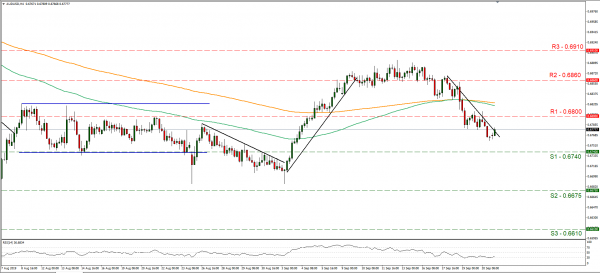

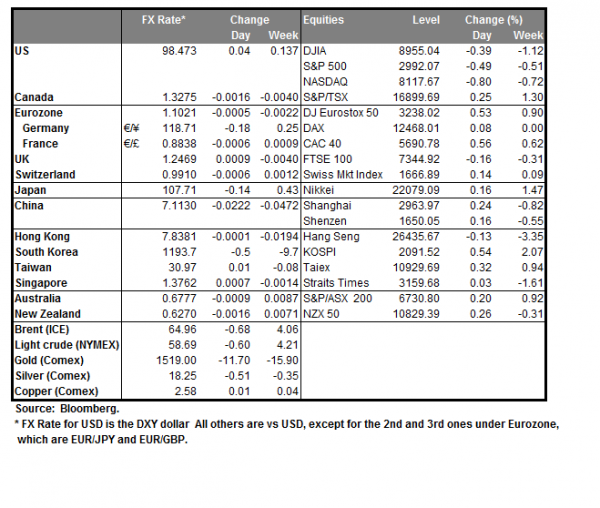

The USD strengthened on Friday as the US-Sino negotiations seemed to be on the positive side, described as productive. Analysts tend to note that there seems to be still a lot of nervousness around in the market, hence the sense of security may be somewhat volatile currently. It should be noted that the markets feeling was a bit more on the pessimistic side as US President had stated that he was not in favour of an interim deal. The positive statements from both sides describing the negotiations as “constructive”, however reversed the mood, striking a delicate balance according to analysts. Should the positive sentiment continue we could see the Aussie and the Kiwi strengthening. AUD/USD dropped on Friday, yet during the late American session and during today’s Asian session, it bounced and stabilized somewhat. For bearish outlook for the pair to change in favour of a sideways movement, we would require a clear breaking of the downward trendline incepted since the 18th of September and it actually is threatening to do just that at the moment. Please bear in mind that the RSI indicator is pretty close to the reading of 30, implying a rather overcrowded short position for the pair. Should the bears dictate the pair’s direction once again, we could see it breaking the 0.6740 (S1) support line and aim for the 0.6675 (S2) support barrier. Should the bulls take over, we could see the pair, breaking the 0.6800 (R1) resistance line and aim for the 0.6860 (R2) resistance level.

Other economic highlights today and early tomorrow

In today’s European session, we get Eurozone’s preliminary PMIs for September. In the American session, we get the Markit US preliminary manufacturing PMI for September and during the Asian session tomorrow Japan’s preliminary Jibun manufacturing PMI for September. As for speakers, NY Fed President Williams, St. Louis Fed President Bullard and San Francisco Fed President Daly are scheduled to speak.

As for the rest of the week

On Tuesday, we get Japan’s Jibun Mfg PMI for September and Germany’s Ifo Business climate indicator also for September. On Wednesday, from New Zealand, we get the trade balance figure for August and RBNZ’s interest rate decision. On Thursday, Germany’s GfK Consumer Sentiment for October, the final US GDP rate for Q2 and the US trade balance for August. On Friday, we get Japan’s Tokyo inflation data for September, France’s HICP rate for September, Eurozone’s Economic Sentiment for September, the US Consumption rate for August, the US durable orders growth rates for August and the US Core PCE price Index for August.

Support: 0.6740 (S1), 0.6675 (S2), 0.6610 (S3)

Resistance: 0.6800 (R1), 0.6860 (R2), 0.6910 (R3)

Support: 1.2400 (S1), 1.2310 (S2), 1.2205 (S3)

Resistance: 1.2510 (R1), 1.2590 (R2), 1.2665 (R3)