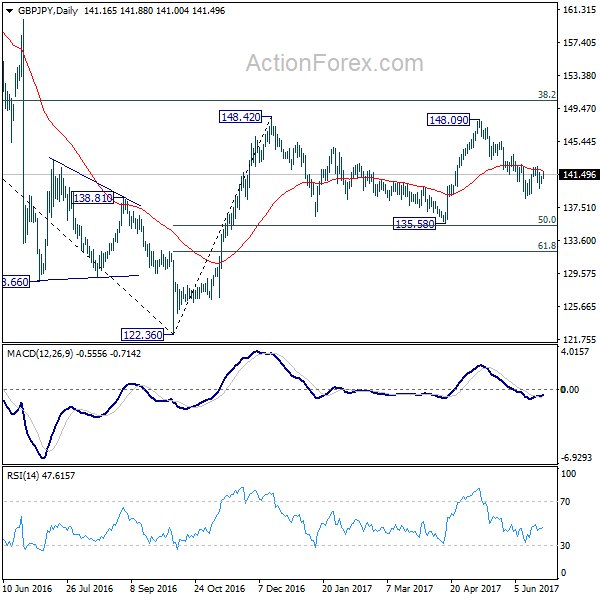

GBP/JPY’s recovery last week was limited below 142.75 minor resistance and there is no confirmation of completion of fall from 148.09 yet. Initial bias remains neutral this week first. On the downside, break of 138.65 will resume the decline from 148.09. In that case, we’d look for bottoming signal around 135.58, which is close to 135.39 fibonacci level, to bring rebound. On the upside, break of 142.75 should confirm completion of the fall from 148.09 and turn bias back to the upside for this resistance.

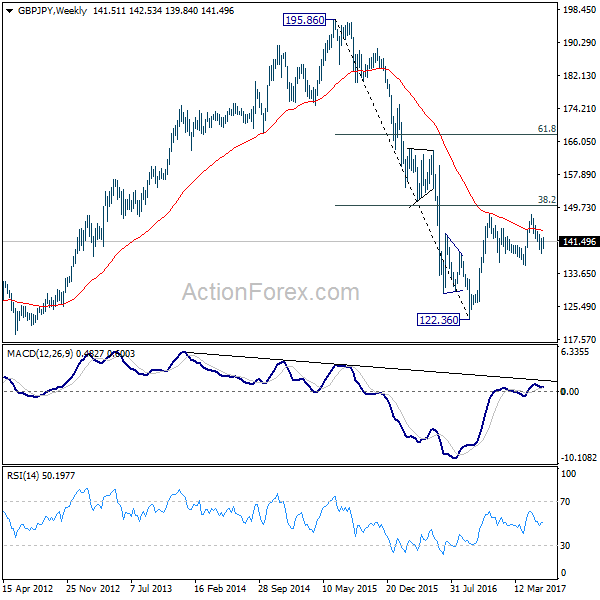

In the bigger picture, while the fall from 148.09 is deeper than expected, we’re not bearish in the cross yet. Price action from 148.42 is possibly developing into a sideway pattern with fall from 148.09 as the third leg. Deeper decline could be seen but we’re looking for strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside. Rise from 122.36 is still mildly in favor to resume at a later stage. However, sustained break of 135.58/39 will confirm reversal and target a retest on 122.36 low.

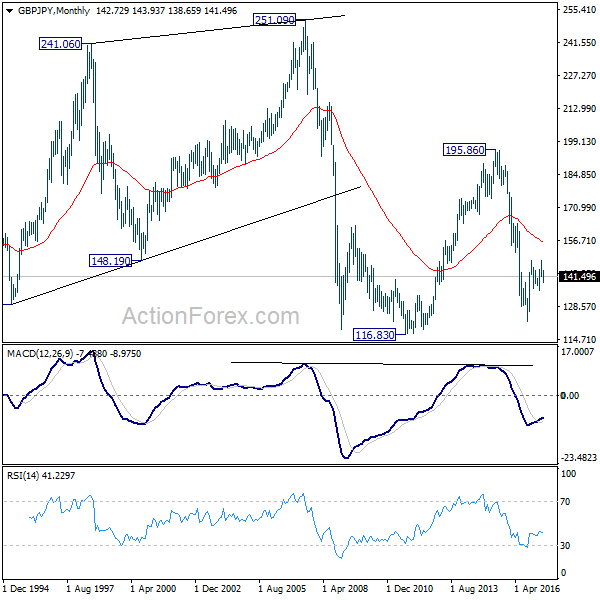

In the longer term picture, based on the impulsive structure of the decline from 195.86 to 122.36, such fall should not be completed yet. But we will now pay close attention to the structure of the rise from 122.36 to determine whether it’s a corrective move, or an impulsive move. That would decide whether a break of 116.83 low would be seen.