Key Highlights

- The British Pound climbed higher sharply above 1.2400 against the US Dollar.

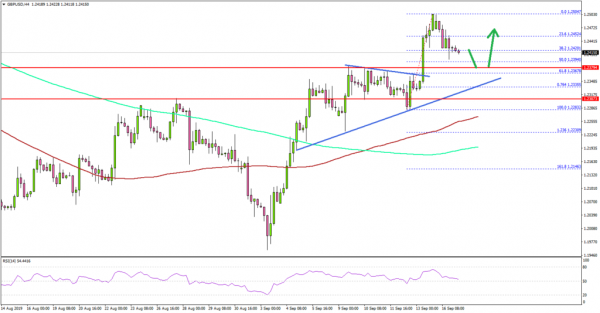

- GBP/USD remains well supported near 1.2375 and a bullish trend line on the 4-hours chart.

- The NY Empire State Manufacturing Index declined from 4.8 to 2.0 in Sep 2019.

- The US Industrial Production might rise 0.2% in August 2019 (MoM), better than the last -0.2%.

GBP/USD Technical Analysis

In the past few days, the British Pound surged higher from the 1.2000 support area against the US Dollar. The GBP/USD pair surpassed many hurdles, including 1.2200 and 1.2350 to move into a positive zone.

Looking at the 4-hours chart, the pair even climbed above the 1.2400 resistance and settled nicely above the 100 simple moving average (red, 4-hours). The bulls even pushed the pair above the 1.2450 and 1.2500 levels.

A new 2-month high was formed near 1.2504 and the pair recently started a downside correction. It traded below the 1.2450 level, and the 23.6% Fib retracement level of the recent rally from 1.2283 to 1.2504.

On the downside, there are many key supports near the 1.2400 and 1.2375 levels. Besides, the 50% Fib retracement level of the recent rally from 1.2283 to 1.2504 is also near the 1.2400 level.

More importantly, there is a bullish trend line in place with support at 1.2340 on the same chart. Therefore, the pair is likely to find bids near 1.2375 or 1.2340 if it continues to correct lower.

On the upside, an immediate resistance is near the 1.2480 level. If there is an upside break above 1.2480 and 1.2500, the pair could rise towards the 1.2600 hurdle in the coming days.

Fundamentally, the NY Empire State Manufacturing Index for Sep 2019 was released by the Federal Reserve Bank of New York. The market was looking for a decline from 4.8 to 4.0.

The actual result was disappointing, as there was a drop to 2.0 in the NY Empire State Manufacturing Index. However, there was a minor increase in new orders, and shipments rose modestly.

The report added:

Twenty-seven percent of respondents reported that conditions had improved over the month, while 25 percent reported that conditions had worsened. The new orders index fell three points to 3.5, pointing to a small increase in orders.

Overall, GBP/USD remains well supported on dips, but it seems like EUR/USD is facing selling pressure and it could continue to slide in the near term.

Upcoming Economic Releases

- German ZEW Business Economic Sentiment Index Sep 2019 – Forecast -37.0, versus -44.1 previous.

- US Industrial Production August 2019 (MoM) – Forecast +0.2%, versus -0.2% previous.

- US Capacity Utilization August 2019 – Forecast 77.6%, versus 77.5% previous.