Key Highlights

- The Euro started a strong rise from the 1.0925 support against the US Dollar.

- EUR/USD is facing resistance near 1.1100 and a bearish trend line on the 4-hours chart.

- China’s Retail Sales increased 7.5% in August 2019 (YoY), less than the last 7.6%.

- The NY Empire State Manufacturing Index could decline from 4.80 to 4.55 in Sep 2019.

EUR/USD Technical Analysis

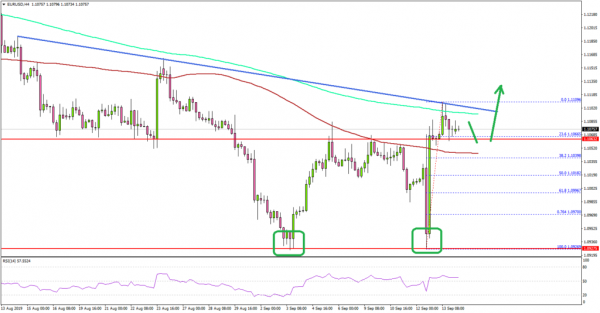

The Euro revisited the last swing low near 1.0925 against the US Dollar. The EUR/USD pair remained well bid near 1.0925 and recently surged above 1.1080 to move into a positive zone.

Looking at the 4-hours chart, it seems like the pair formed a double bottom pattern near the 1.0925 area. As a result, there was a sharp increase above the 1.1050 and 1.1080 resistance levels.

Moreover, there was a close above the 1.1050 level and the 100 simple moving average (red, 4-hours). It opened the doors for more gains and the pair spiked above the 1.1100 resistance area.

However, the pair failed to continue higher and formed a high at 1.1109. At the moment, it is correcting lower and is trading below 1.1100. An immediate support is near the 1.1065 level. It coincides with the 23.6% Fib retracement level of the last wave from the 1.0926 low to 1.1109 high.

The main support is near the 1.1050 level and the 100 simple moving average (red, 4-hours), below which the pair could decline back towards the 1.1000 level in the near term.

On the upside, the pair is facing resistance near 1.1100 and a bearish trend line on the same chart. If there is a successful break above 1.1100 and the 200 simple moving average (green, 4-hours), the pair could continue to rise towards 1.1120 and 1.1150.

Looking at GBP/USD, the pair is surging and is trading nicely above the 1.2400 level. Overall, it seems like the US Dollar is struggling to hold gains and it might correct further lower in the coming sessions.

Upcoming Economic Releases

- NY Empire State Manufacturing Index for Sep 2019 – Forecast 4.55, versus 4.80 previous.