Gold price traded to a new yearly high at $1,557 and recently corrected sharply below $1,530. Conversely, crude oil price is trading nicely above the $55.70 and $55.25 supports.

Important Takeaways for Gold and Oil

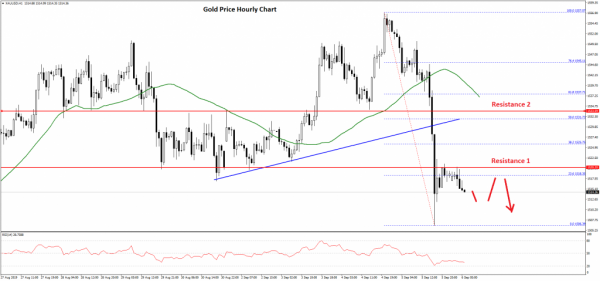

- Gold price topped near the $1,557 level and recently declined sharply against the US Dollar.

- There was a break below a key bullish trend line with support near $1,530 on the hourly chart of gold.

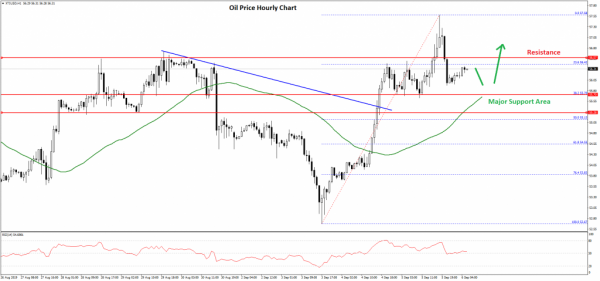

- Crude oil price is trading with a positive bias and recently traded towards the $57.50 level.

- There was a break above a major bearish trend line with resistance near $55.55 on the hourly chart of XTI/USD.

Gold Price Technical Analysis

Earlier this week, gold price resumed its upward move above the $1,540 level against the US Dollar. The price even broke the $1,555 high and traded to a new yearly high at $1,557 before starting a downside correction.

The price declined sharply and broke the $1,540 and $1,525 support levels. The decline was such that there was a close below the $1,525 level and the 50 hourly simple moving average. A swing low was formed near $1,506 on FXOpen and the price is currently correcting losses.

It tested the $1,520 resistance and the 23.6% Fib retracement level of the recent decline from the $1,557 high to $1,506 low. However, the upward move seems to be capped near $1,520.

The price is currently trading with a bearish angle below the $1,515 level. An immediate support is near the $1,510 level, below which the price could revisit the $1,505 and $1,500 support levels.

On the upside, a break above the $1,520 resistance might start a decent recovery towards the $1,530 level. The 50% Fib retracement level of the recent decline from the $1,557 high to $1,506 low is also near $1,530 to act as a resistance.

Overall, gold price remains at a risk of more downsides towards $1,500 as long as it is trading below the $1,520 level.

Oil Price Technical Analysis

There was a fresh increase in crude oil price from the $52.67 swing low against the US Dollar. The price traded above the $53.80 and $54.00 resistance levels to move into a positive zone.

Moreover, there was a close above the $55.00 pivot level and the 50 hourly simple moving average. There was a break above a major bearish trend line with resistance near $55.55 on the hourly chart of XTI/USD.

Finally, the price climbed above $56.00 and traded to a new monthly high at $57.58. Recently, the price corrected lower below the $57.00 level and the 23.6% Fib retracement level of the upward move from the $52.67 low to $57.58 high.

However, there are many supports on the downside near the $55.80 and $55.25 levels. The 50% Fib retracement level of the upward move from the $52.67 low to $57.58 high is also near the $55.13 level.

Therefore, the price is likely to climb higher again as long as it is trading above the $50.00 support level. Conversely, a close below the $55.00 support and the 50 hourly simple moving average could start an extended decline in the near term.

The next key support is near the $53.80, where crude oil price might find a strong buying interest. On the upside, the main resistances are near $57.00 and $57.50.