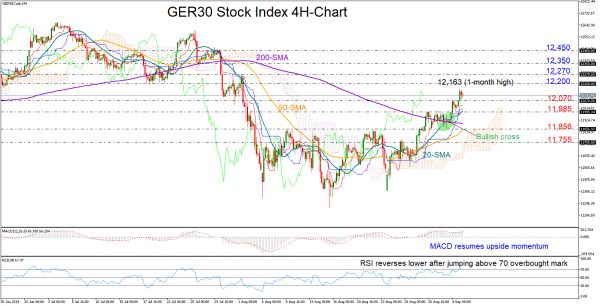

The GER30 index stepped on the 200-period simple moving average (SMA) on Wednesday and accelerated to one-month highs.

While the RSI’s peak in the overbought territory suggests that the rally is overstretched and is time for a downside correction, the positive momentum in the MACD and the upward direction in the red Tenkan-sen line signals that any weakness could be temporary.

Even more encouraging is the bullish cross between the 20- and the 200-period SMAs that foresees the continuation of the upward pattern.

The 12,200-12,270 restrictive area is currently in the spotlight as any violation could add more legs to the rally and shift resistance up to 12,350. Should the buyers persist, the price could also retest a stronger obstacle around the 12,450 level.

On the flip side, should the bears retake control under the 12,070 mark, traders could look for support near the 11,985 number, where the 20-period SMA happens to be at the moment. Lower, a taller wall could be standing at 11,856, a break of which would push the market back to neutrality and the price down to 11,755.

Overall, GER30 index is bullish in the short-term picture. The market could chart a different direction above 12,270 and below 12,070.