With no major developments with the US -China trade war, US equities are set for a lackluster open as the focus shifts to Brexit and Italian politics. The key chart investors’ eyes are glued to is the spread between the 2-year Treasury yield and 10-year note, which is accelerating its inversion to the lowest levels since the financial crisis. The deeper the inversion and the longer we stay inverted, the greater the calls will be for a sustained recession.

Brexit

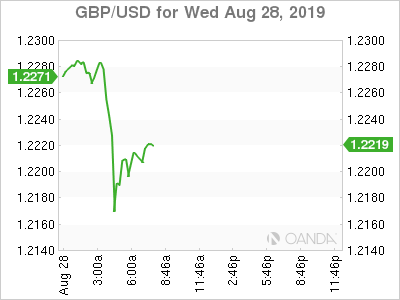

The British pound continues to be driven by Brexit and the latest selloff stemmed from news that PM Johnson has asked the Queen to agree to prorogue Parliament. Prorogation means Parliament cannot formally debate government policy and legislation would have little time to push through anything that could prevent a no-deal Brexit.

PM Johnson’s letter shows he is set on running down the clock in hopes to force both concession from the EU and not allow Parliament in preventing Brexit. With summer recess ending, the soap opera that is Brexit will see the debates pick up steam next week. While, we inch closer to the October 31st deadline, pound options suggest a no-deal Brexit could already be priced in. Longer-term positions on the British pound are less bearish. If Johnson does deliver a no-deal Brexit, sterling will tank 5% easily to 1.16 initially and we could see momentum keep the pressure on all the way to 1.10.

Italy

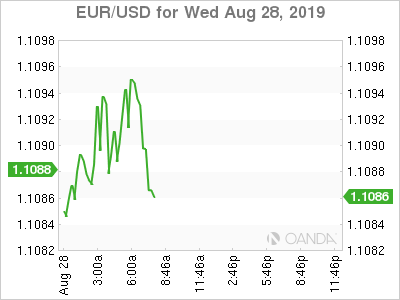

Italian yields on 10-year old debt is falling to record lows as political optimism in Rome is growing as coalition talks between the Five Star and the Democratic Party. Democrats (PD) chief Zingaretti is set to tell President Mattarella the party supports Conte remaining PM. The euro was unfazed by another round of softer German data, import price data, and seems to remain steady on the optimistic Italian political headlines.

Oil

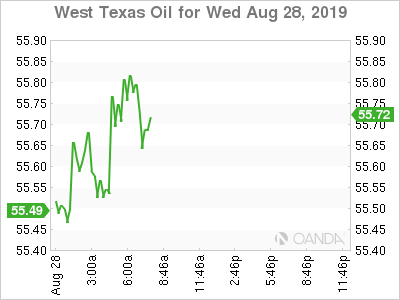

Energy prices remained bid after the API weekly crude inventory data posted the largest decline since June, a 11.1 million barrel draw, suggesting demand is not falling off a cliff. If the EIA report confirms the strong drop with stockpiles, we will some recession fears ease.

Oil could remain bullish as US stockpiles have been consistently declining and we could see Hurricane season provide some disruptions over the next couple weeks. The wildcard for energy traders could be if we see any de-escalation with the US-China trade war, any scaling back or delays in tariffs could help West Texas Intermediate crude make an attempt at the $60 a barrel level.

Gold

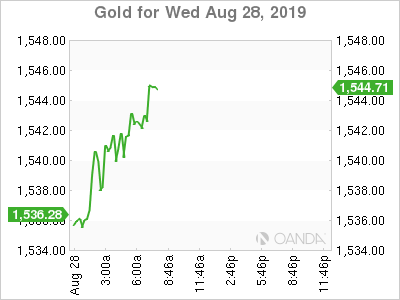

Gold’s rally could continue as no-deal Brexit risks surge and as US equities appear to have run out of steam as the yield curve inversion with the 10-year and 2-year continues to deepen further. Gold’s path higher will remain supported on global negative interest rates, increased central bank demand, prospects of additional monetary and fiscal stimulus, escalations with trade wars, and global recession concerns.