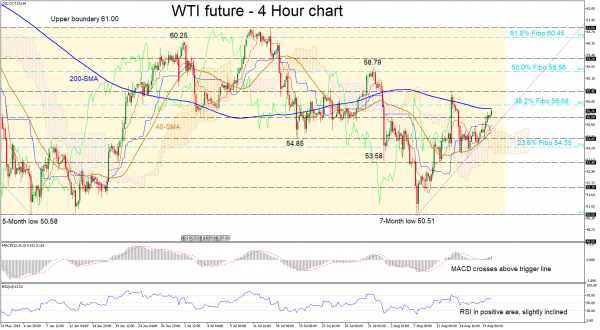

WTI oil futures collapsed back down to the lower boundary of the nearly three-month trading range, registering a seven-month low of 50.51, before the bulls rallied back up to the 200-period simple moving average (SMA) on the four-hour chart.

The MACD and the RSI are also indicating some weakness but suggest a positive directional momentum is still in place. They are both in the positive region with the MACD above its red trigger line and the RSI slowly creeping higher towards overbought areas.

If the bears manage to block the jump above the 200-period SMA, initial support moving down may come at the 56.00 near level, before retracing to test the uptrend line currently at 55.20. A breach lower could find support at 54.80 ahead of 54.35, which is the 23.6% Fibonacci retracement level of the down leg from 66.57 to 50.58.

If the oil price rises above the 200-period SMA, immediate resistance could come from the 38.2% Fibo of 56.68 before the swing high of 57.45 can unravel. Pushing higher could reel in the 58.56 level which is the 50.0% Fibo near the next swing high.

Overall, the short-term outlook remains bullish and a close above 58.79 would confirm that. Otherwise, a break below 53.50 level could shift the bias back to neutral.