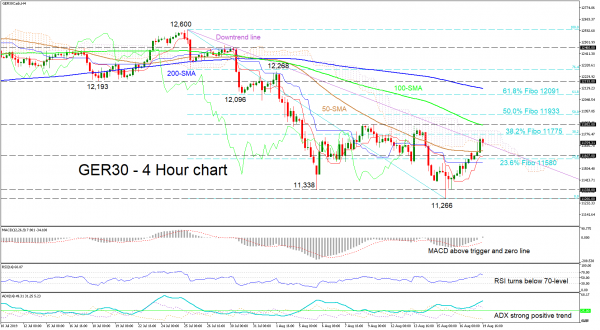

The GER30 index put in a rally, pushing upwards off the 11,266 low of August 15. The price surpassed 11,580, which is the 23.6% Fibo of the down leg from 12,600 to 11,266 and near the resistance of 11,607 from June 3. More importantly the appreciation of price moved above the 50-period simple moving average (SMA) and downtrend line to enter the Ichimoku cloud.

Although the momentum indicators suggest a short-term positive directional trend in place, traders should be cautious as the MACD is only slightly in the positive region and the RSI has turned down before reaching the overbought level. Further reflecting weakness in the positive outlook are the SMAs which are sloping downwards, and the behaviour of the candles, which are stalling just at the break of the trendline.

If the 38.2% Fibo of 11,775 manages to hold, the price may return to the downtrend line before retesting the 11,607 support slightly above the 23.6% Fibo of 11,580. Collapsing lower could bring the 11,338 low in focus before retackling the 11,266 low of August 15.

The bullish picture would need the price to move out of the Ichimoku cloud to face the 100-period SMA lying at the previous swing high of 11,852. Surpassing the swing peak opens the door to the 50.0% Fibo of 11,933 followed by the 12,091 resistance coming from the 61.8% Fibo.

Overall, the short-term bias is still bearish but a close above 12,268 would turn the bias back to neutral.