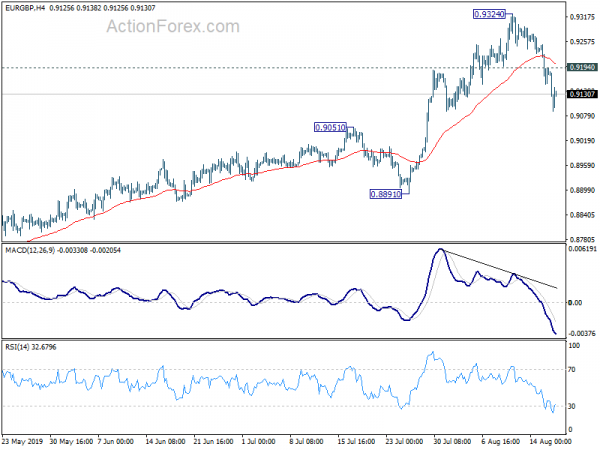

EUR/GBP edged slightly higher to 0.9324 last week but formed a short term top there. Initial bias is mildly on the downside this week as corrective from 0.9324 could extend lower to 55 day EMA (now at 0.9025). But strong support should be seen in 0.8891/9051 support zone to bring rise resumption. On the upside, above 0.9194 minor resistance will turn bias back to the upside. Break of 0.9324 will resume larger up trend.

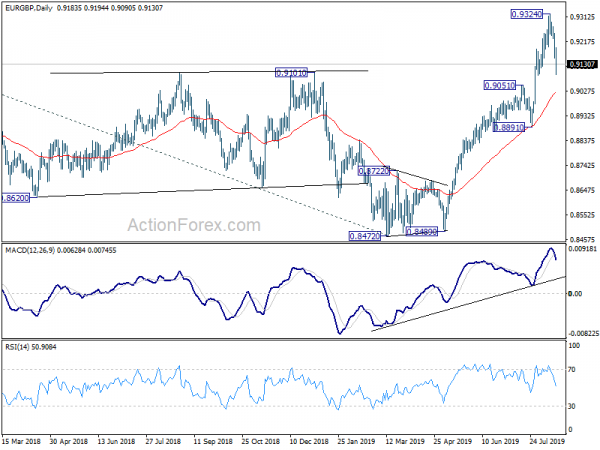

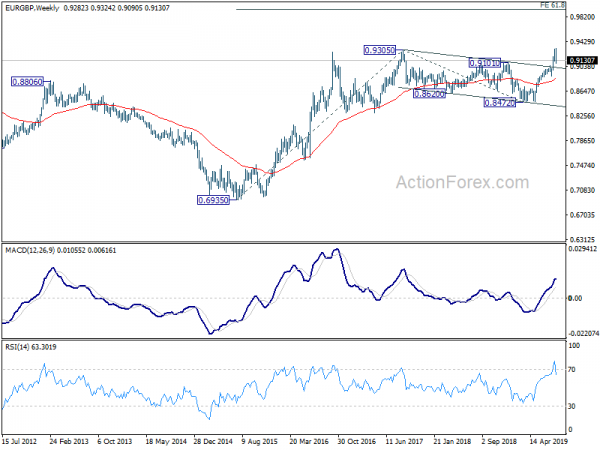

In the bigger picture, up trend from 0.6935 (2015 low) should be resuming. Sustained break of 0.9305 will confirm and target 0.9799 (2008 high) and then 61.8% projection of 0.6935 to 0.9305 from 0.8472 at 0.9937. In any case, medium term outlook will remain bullish as long as 0.8891 support holds, in case of deep pull back.

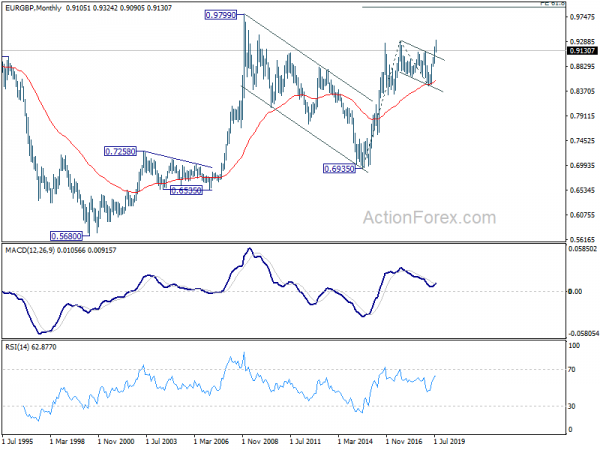

In the long term picture, we’re holding on to the view that rise from 0.6935 (2015 low) is resuming the up trend from 0.5680 (2000 low). As long as 38.2% retracement of 0.6935 to 0.9306 at 0.8400 holds, further rise should be seen through 0.9305 to 0.9799 and above down the road.