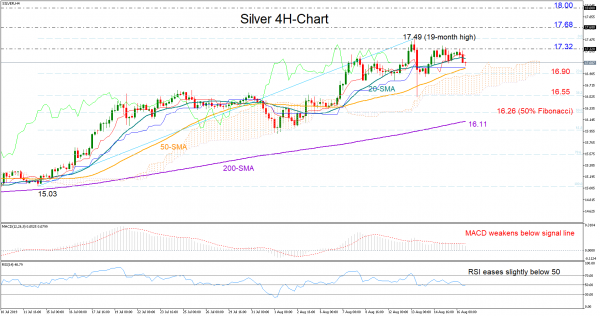

Silver topped near its 2018 peaks this week before pulling slightly back, with the MACD and the RSI pointing now to a neutral-to-bearish mode in the short-term; the former is increasing negative momentum below its red signal line, while the latter is fluctuating slightly below its 50 neutral mark.

The support area around the 23.6% Fibonacci of 16.90 of the upleg from 15.03 to 17.49 will be closely watched if the decline extends. In case of a sharper downside move, the 38.2% Fibonacci and the lower bottom of the Ichimoku cloud, both near 16.55, may prove more challenging as any violation at this point could add more pressure to the market, sending the price towards the 50% Fibonacci of 16.26 and the 200-period simple moving average (SMA).

In the event of an upside correction, the bulls could retest the highs between 17.32 and 17.49. if the rally breaks the 2018 top of 17.68 too, the door would open for the 18.00-18.50 restrictive area.

In the bigger picture, the increasing distance between the 50- and the 200-period SMAs endorses the strong bullish outlook.