The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.12005

Open: 1.11984

% chg. over the last day: -0.02

Day’s range: 1.11973 – 1.12140

52 wk range: 1.1034 – 1.1817

An ambiguous technical picture has developed on the EUR/USD currency pair. A trading instrument is consolidating. EUR/USD quotes continue to test local support and resistance levels at 1.11850 and 1.12150. Participants in the financial markets expect additional drivers. We do not rule out further recovery of the single currency. We recommend keeping track of up-to-date information regarding the trade conflict between the USA and China. Positions must be opened from key levels.

Today, the news background is pretty calm. At 15:30 (GMT+3:00), the US will publish a report on the number of initial jobless claims.

Indicators do not provide precise signals, the price has crossed 50 MA.

The MACD histogram is close to 0.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line which points to a bullish sentiment.

Trading recommendations

Support levels: 1.11850, 1.11600, 1.11150

Resistance levels: 1.12150, 1.12450, 1.12800

If the price fixes above 1.12150, expect further growth toward 1.12450-1.12600.

Alternatively, the quotes can decrease toward 1.11600-1.11400.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.21368

Open: 1.21678

% chg. over the last day: +0.23

Day’s range: 1.21451 – 1.21908

52 wk range: 1.2080 – 1.3385

The GBP is still in a lateral movement. There is no defined trend. At the moment, the local support and resistance levels are 1.21300 and 1.21850. Uncertainty around Brexit continues to put pressure on the British currency. Earlier, the government of Boris Johnson reported that Britain did not intend to resume negotiations with the EU on Brexit. We recommend tracking information on this issue. Positions must be opened from key levels.

The Economic News Feed for 08.08.2019 is calm.

The indicators do not provide precise signals, the price crossed 50 MA and 100 MA.

The MACD histogram is close to 0.

The Stochastic Oscillator is in the neutral zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.21300, 1.20850, 1.20500

Resistance levels: 1.21850, 1.22500, 1.23000

If the price consolidates above 1.21850, expect further recovery toward 1.22300-1.22500.

Alternatively, the price could reduce toward 1.20850-1.20700.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.32756

Open: 1.33038

% chg. over the last day: +0.26

Day’s range: 1.32720 – 1.33140

52 wk range: 1.2727 – 1.3664

The USD/CAD currency pair stabilized after a rather protracted rally. CAD is currently consolidating. The local support and resistance levels are: 1.32650 and 1.33100, respectively. Support for the Canadian dollar is provided by positive data on business activity from Ivey. We recommend paying attention to the dynamics of oil quotes. Positions must be opened from key levels.

The news background on the Canadian economy is pretty calm today.

Indicators do not give accurate signals: the price is consolidating near 50 MA.

The MACD histogram is located near the 0 mark.

The Stochastic Oscillator is near the oversold zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.32650, 1.32400, 1.3200

Resistance levels: 1.33100, 1.33400

If the price consolidates above 1.33100, expect further growth toward 1.33400-1.33600.

Alternatively, the quotes can drop toward 1.32400-1.32100.

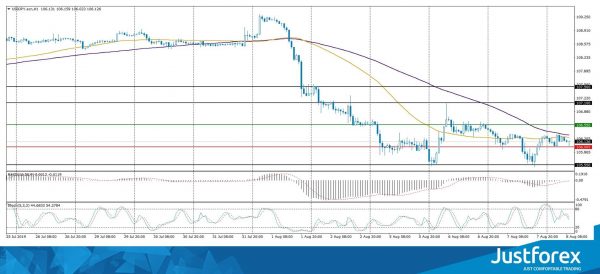

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 106.460

Open: 106.260

% chg. over the last day: -0.35

Day’s range: 106.005 – 106.299

52 wk range: 104.97 – 114.56

The USD/JPY is still in a sideways movement. There is no defined trend. At the moment, the trading instrument is consolidating near the round level of 106,000. The 106.550 mark is a key resistance. USD/JPY quotes hcan correct further after a significant collapse since the beginning of the current month. We recommend that you pay attention to the dynamics of yield on US government bonds. Positions must be opened from key levels.

Japan has recently published an optimistic report on the payment balance.

Indicators do not give accurate signals, the price crossed 50 Ma and 100 MA.

The MACD histogram is close to 0.

The Stochastic Oscillator is in the neutral zone, the %K line is below the %D line which points to a bearish sentiment.

Trading recommendations

Support levels: 106.000, 105.550

Resistance levels: 106.550, 107.100, 107.500

If the price consolidates above 106.550, expect a correctiont toward 107.000.

Alternatively, the price could decrease toward 105.600-105.400.